U04 End of Period

U04 End of Period

U0471 Estimated Property Tax

| EOP Only | Yes |

| Frequency | Monthly |

| Sequential Updates | Yes |

| Skip Notes | No restrictions |

For more information about End of Period, refer to U04 End of Period Overview.

For more information about End of Period, refer to U04 End of Period Overview.

Sequential Updates: This EOP module runs as part of U0411 Sequential Updates.

Sequential Updates: This EOP module runs as part of U0411 Sequential Updates.

Overview

This EOP update assesses the estimated property tax for assets with property tax description code of EPTX as set in U0105 Assessment at asset level. The module considers assets tied to leases of non-NP* or NC* status with the last payment due within 60-90 days from the current date the end of month is being processed. Asset invoices in the last 14 months must have property tax amount and property tax description code of EPTX. Users must set EPTX property tax description code by U0722 Custom Code under PPT.CD code category. The extracted list of asset invoices will be sum up to multiply by the factor of .90 to calculate the estimated property tax. LeasePak stores the estimated property tax assessed in rbs Batch Assessment table. The rbs table record for an asset may be updated through U0232 Batch Assessment Maintenance update before the estimated property tax is assessed in the next day end of period processing by U0418 Batch Assessment update. However, users can assess the estimated amount of an asset by using U0105 Assessment interactive update.

This module will be executed as part of sequential updates, and will be run as monthly sequential updates. Users must purchase Batch Assessment module to use EOP (EOM) Sequential Updates – Estimated Property Tax.

U0471A Estimated Property Tax Audit and U0471 Estimated Property Tax Exception reports are created by this module. User must set up EPTX-estimated property tax description code under PPT.CD code category from U0722 Custom Code to avoid exceptions. Estimated Property Tax Audit report shows assets with amounts of previous property tax and estimated property tax.

The following steps explain the processing steps of this update:

- LeasePak considers all active leases in the selected portfolio where activity status is non-NP*/NC*, switch "Estimated Property Tax (Y/N) = N", and lease final payment is due in three calendar months and lease final payment is due in three calendar months from the current date end of month processed.

- The leases found applicable which are due within 60-90 calendar days from the current date EOP runs will be considered to check for invoices in the last 14 months. The assets must have property tax defined with property tax description code of EPTX. LeasePak checks for the asset having property tax assessed in last 14 months from rar Accounts Receivable table and its corresponding database tables.

- For assets having total property tax amount assessed and are on lease with

pay_typ_s = '01'record, the total property tax amount calculated for each asset will be multiplied by the factor of .90 to calculate the final estimated property tax. LeasePak writes a Batch Assessment record in rbs Batch Assessment table where property tax description code = 'EPTX'. Once executed the update sets the "Estimated Property Tax Assessed Y/N" flag to Y at lease level. LeasePak continue to look for leases with assets having property tax assessed in the last 14 months to calculate estimated property tax.

Property Tax Assessment is applicable at asset level only that is on lease and is stored in the rbs Batch Assessment Table.

Property Tax Assessment is applicable at asset level only that is on lease and is stored in the rbs Batch Assessment Table.

Example

The following example explains how the estimated property tax assessed for an asset that has an invoice in last 14 months with the property tax amount and property tax description code of EPTX:

If EOM is scheduled for 8/31/18 and is run on this date then LeasePak will look for leases that are due for final payments from 11/01/18 through 11/31/18.

If EOM runs on 9/31/18, then LeasePak fetches a record in the last 14 months for invoices beginning from 7/1/2017 to 8/31/2018 and checks which invoices have property tax amount assessed where the asset is still on lease with pay_typ_s='01' record.

| Asset# | Invoice# | Property Tax Assessed |

| 1 | 101 | $100 |

| Total property tax assessed for Asset# 1 | $100 | |

| 2 | 201 | $100 |

| 202 | $100 | |

| Total property tax assessed for Asset# 2 | $200 | |

| 3 | 301 | $150 |

| 302 | $150 | |

| 303 | $100 | |

| Total property tax assessed for Asset# 3 | $400 | |

Estimated property tax calculation for the assets found with total amount of property tax and property tax description code as EPTX in the last 14 months:

| Asset# | Invoice# | Property Tax Assessed |

| 1 | 101 | $100 |

| Total property tax assessed for Asset# 1 | $100 | |

| Estimated property tax (.90) | 100 * .90 = $90 | |

| 2 | 201 | $100 |

| 202 | $100 | |

| Total property tax assessed for Asset# 2 | $200 | |

| Estimated property tax (.90) | 200 * .90 = $180 | |

| 3 | 301 | $150 |

| 302 | $150 | |

| 303 | $100 | |

| Total property tax assessed for Asset# 3 | $400 | |

| Estimated property tax (.90) | 400 * .90 = $360 | |

Reports

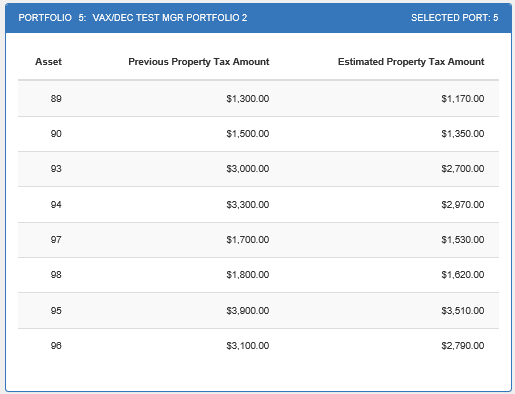

Estimated Property Tax Audit Report

The estimated property tax audit report [U0471A] reports at asset level and includes the following information:

- ASSET

- PREVIOUS PROPERTY TAX AMOUNT

The total property tax amount assessed in the last 14 months is displayed. - ESTIMATED PROPERTY TAX AMOUNT

The estimated property tax amount of the asset is displayed. This is the amount of the previous property tax amount multiplied by the factor of .90.

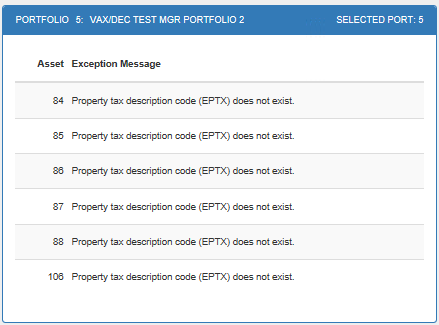

Estimated Property Tax Exception Report

The estimated property tax exception report [U0471B] reports at asset level and includes the following information:

- ASSET

- EXCEPTION MESSAGE

The exception message is displayed.