U0212 Portfolio

Miscellaneous Customizations

Heading names of individual screens listed below are an aid to reference and navigation, and may reflect only some of the settings available on those screens.

- Name, Portfolio Interest Type, Invoice Codes

- Deferral, Year End, FMV, EXT/DEF, Auto Suspend

- Cashier's Checks, Upfront Sales Tax, Delinquency Categories

- Grand Total Page Breaks, Miscellaneous Settings

- Asset Focus, Suspended Earnings, Dealer Settings

Name, Portfolio Interest Type, Invoice Codes

This screen is used to establish or change name and address and other miscellaneous information for the portfolio.

- NAME

Enter or change the portfolio name. This name appears on the first line of report headings for the portfolio. Also, the name for default portfolio 1 appears at the top of all LeasePak screens.

- ADDRESS / CITY / STATE / ZIP

Enter the portfolio address. These fields are informational only.

- PHONE

Enter the portfolio area code and phone number. This field is informational only.

- DIVISION NAME (REPORT HEADING)

Enter the portfolio division name. This name, if entered, appears on the second line of all report headings for the portfolio.

- INVOICE HEADING CODE

This field is not used in LeasePak.

- INVOICE FORMAT CODE

This field is not used in LeasePak.

-

LAST PAID AMOUNT ON INVOICE (Y/N)

Check this box to have the amount from rls.cur_paid_d (appearing as R0905 Lease Inquiry AMOUNT CURR PAID) carried over into rls.lst_paid_d (appearing as R0905 Lease Inquiry AMOUNT LAST PAID) during invoicing at End of Period.

- SORT INVOICES BY CUSTOMER (Y/N)

This field is not used in LeasePak. If the user generates invoices from the old LeasePak scratch files, this check box should only be selected if the user's database is set up so that all lessees belong to customers. Otherwise, leave this field unchecked.

- PORTFOLIO INTEREST TYPE

This 4-character code indicates the type of leases that are included in the portfolio. It is structured in the following manner:Nxxx or Rxxx

The first character is N or R. N indicates base rates are not monitored (i.e., no floating rate leases in the portfolio). R indicates base rates must be updated daily (i.e., floating rate leases exist in the portfolio).

If R is entered, the user must update the base rates each day before New Lease update [U0101], Accrual update [U0301], Payoff update [U0103], or End of Period update [U0401] may be entered.

xNxx or xPxx

The second character is either N or P. N indicates no precomputed interest leases exist in the portfolio. P indicates they do. Refer to the Calculations document of the Reference Guide for definitions of precomputed leases.

xxNx or xxSx

The third character is either N or S. N indicates no simple interest leases exist in the portfolio. S indicates that they do. Refer to the Calculations document of the Reference Guide for definitions of simple interest leases.

xxxN or xxxO

The fourth character is either N or the letter O. N indicates no operating leases exist in the portfolio. O indicates they do. Refer to the Calculations document of the Reference Guide for definitions of operating leases. Operating leases are designated by a lease type of OPER, entered during the Book Lease option of the New Lease update [U0101].

A warning message is displayed if the base rate indicator is turned on so that base rates must be updated daily or if any of the 3 types of leases is specified as not existing in the portfolio. This code is used by certain functions, such as the Trial Balance report [R0901], which report separately on leases in each of these 3 categories. Therefore, care should be exercised when changing this code.

- REMITTANCE

CODE

The remittance address is the return address that is printed on the invoice and is maintained through the Auxiliary Address update [U0704]. Enter or change the remittance code that indicates how LeasePak derives the default remit to address when a lessee address is added or changed (through the Lessee update [U0203]).

Valid remittance codes are:CL The default remittance address is the remittance address set up with a code of 1. If none of the following special default methods are used, then this method should be selected, and a remittance address with code 1 should be established through the Auxiliary Address update [U0704].

COMP The default remittance address is the address coded to match portfolio and company number of the lease. For example, if the lease belongs to portfolio 1 and company 2, a remittance address of 12 should be set up. Use the Auxiliary Address update [U0704] to set up a remittance address for each combination of portfolio and company used.

ENT No default remittance address exists. The remittance address must be entered by the user for each lease.

GEO1 The default remittance address is based on the lessee address state. Each remittance code entered through the Auxiliary Address update [U0704] must have a list of states associated with it. (Refer to the documentation for Auxiliary Address update [U0704]).

PORT The default remittance address is coded to match the portfolio number of the lease. For example, if the lease belongs to portfolio 2, remittance address 2 should be set up. Use the Auxiliary Address update [U0704] to set up a remittance address for each portfolio used. Consider this option only if the Multi Portfolio Processing module is purchased.

REGN The default remittance address is coded to match the company and region number of the lease. For example, if the lease belongs to company 2, region 3, remittance address 23 should be set up. Use the Auxiliary Address update [U0704] to set up a remittance address for each combination of company and region used. Consider this option only if the Multi Portfolio Processing module is not purchased.

In all cases, if the default remittance address does not exist, no default is displayed by the Book Lease option of the New Lease update [U0101] or the Lessee update [U0203].

- BATCH QUEUE NAME

Enter or change the logical name of the batch queue to which batch report jobs are to be directed (e.g., SYS$BATCH). Logical names are system parameters, so the system manager should be consulted before a logical name is entered or changed. LeasePak does not verify the logical name. If an invalid name is entered, batch reports cannot be executed.

- LASER INVOICE FORM CODE (GROUP)

This field is not used in LeasePak.

- LASER INVOICE FORM CODE (INDIVIDUAL)

This field is not used in LeasePak.

- REVERSAL BANK CODE

This parameter appears only if the Multiple Banks module is purchased. When the Reverse Payment to Effective Date option of the Payment update [U0102] is used, this REVERSAL BANK CODE will default for the payment reversal. It affects only the [U0102RP] option, and has no effect on other updates. It may be overridden if desired. Generally a "dummy" or clearing bank code would be used as the default for payments reversed back to the commencement date prior to rebooking.

- DEFICIENCY PORTFOLIO

This field indicates that whether or not the portfolio is designated as a deficiency portfolio. Check this box to make the selected portfolio a deficiency portfolio and unchecked otherwise. If this check box is selected, leases with an activity status of either NCxx or NPxx that are being change keyed into this deficiency portfolio and have lease-level accrual-basis assessments that are being change keyed into the deficiency portfolio will be charged-Off from the non-deficiency portfolio using end of term (EOT) lease gross charge-off general ledger account when a change key is done.

- CURRENCY TYPE CODE

Select currency type code for debits.- AUD - Australian Dollar

- CAD - Canada Dollars

- USD - Us Dollars

Deferral, Year End, FMV, EXT/DEF, Auto Suspend

This screen is used to establish or change miscellaneous information for the portfolio.

- LAST DAY OF THE MONTH

Enter or change the day the accounting books are closed monthly. This is the day End of Month processing should normally be submitted. End of Month may be submitted up to 5 days before this day for the current month. End of Month may also be submitted later, any number of days after this day. However, a month should never be skipped entirely. To specify that End of Month processing should normally occur on the last day of each month, enter 31. LeasePak adjusts this number for months with fewer than 31 days.

With the Month End Accrual and Invoicing module (Part of the JULE Fund 1999 package), LeasePak can accrue and invoice up to the actual month end when End of Month is submitted prior to the actual end of month day. The day entered in this field will guide the actual number of days that EOM can be submitted and all leases included. The exact day when accruals and /or invoicing will take place will depend on the INVOICING DEFERRAL DAYS and ACCRUAL DEFERRAL DAYS set below.

Late Charges will only be assessed when the lease is past due. For example, End of Month is run on the 29th and LeasePak is processing pre-accruals and invoices up to the 31st of the month, Late Charges will not be assessed until on or after the 31st of the month.

Additionally, when Advance Invoicing is on, the Place Late Charge on Delinquent Invoice field in Lease Form [U0721] must be set to 'Y'.

- APPLY CREDIT MEMO FREQUENCY

Select 'D' to set this field to process outstanding invoices on daily basis. Select 'M' for monthly credit memo or select O to turn off credit memo processing for all of the outstanding invoices. This field will determine whether to apply credit memo daily, monthly, or to turn off credit memo processing during EOP for the outstanding invoice amount. LeasePak defaults this field to 'M' to apply credit memo on monthly basis.

- GRACE PERIOD IN DAYS

Enter or change grace period at the portfolio level. Portfolio grace period determines the group of leases to accrue and/or invoice during End of Day processing, even if the grace period for the lease is changed when the lease is booked. LeasePak waits this number of days before accruing and invoicing leases for the following month. For example, if portfolio grace period is 10 days and the lease grace period is 5 days, LeasePak waits until the eleventh of the month before accruing leases with payments due on the first. This allows late charge calculation and assessment to be performed for all leases in the portfolio at the time of the accrual. If the lease is accrued interactively between the sixth and the eleventh of the month, however, it is accrued for the next month.

You can set the grace period for any amount between 0 and 999 days.

Grace period is set up at the portfolio, lease form, and lease levels. Portfolio level grace period should be the maximum grace period allowed for any lease whose late charge calculation is not controlled by the actual number of days delinquent (i.e., late charge method is not GFTx or GFLx). The actual grace period, if it differs from the portfolio period, may be changed when the lease is booked. Refer to the LATE CHARGE INFORMAITON screen of the Lease Form update [U0721] for more information regarding late charge methods.

Notes on specific late charge methods. For leases using 'GFT*' or 'GFL*' late charge methods, you must set grace days through the Lease Form [U0721] and override if needed at the application/lease level. For leases using late charge methods that assess only one late charge per invoice (such as 'PERC' and 'FIX'), LeasePak will assess the late charge only if both the following are true:

1. Invoice due date + grace days < current accrued-to date

2. Invoice due date + grace days >= current accrued-to date - one month

- SUSPENSE

LIMIT IN DAYS

Enter or change the number of days to wait before a cleared suspense item is automatically deleted by the End of Day process. A cleared suspense item has zero remaining balance. An open suspense item (i.e., one with a non-zero remaining balance) is never automatically deleted, regardless of the number of days it has been on file.

- FISCAL

YEAR END

Enter or change the corporate fiscal year end date in MM/DD format. The End of Year process automatically executes after End of Month process for the specified month of the year end. For example, if fiscal year end is 06/30, the End of Year process executes immediately after End of Month for June. The End of Year Tax Model may be executed only between this date and the TAX REPORTING DEADLINE FOR YEAR END date.

- TAX

REPORTING DEADLINE

Enter or change the tax reporting deadline in MM/DD format. The End of Year tax model may be executed between the FISCAL YEAR END and this date. For example, if fiscal year end is 6/30 and tax reporting deadline is 9/30, the tax model may be executed between 6/30 and 9/30. The tax model allows "what-if" modeling and file changes to depreciation and/or ITC methods specified for assets booked during the just-completed fiscal year.

- ITC CUTOFF DATE

Enter or change the ITC cutoff date in MM/DD format. Depreciation and ITC methods for leases booked during the just-completed fiscal year may only be changed between the FISCAL YEAR END and this date.

- INVOICING

DEFERRAL DAYS

This field is the number of days AFTER payment due day that the lease should be invoiced for the following month. For example, if this field is set to10 days, cycle invoices run every day, and today is the eleventh, LeasePak will invoice today for leases due on the first of next month. If the lease is invoiced interactively, Invoicing Deferral Days is not applicable.

Possible deferral and invoicing days valid ranges for the following payment frequencies are as follows:- Bi-Weekly - 0-14

- Weekly - 0-7

- Monthly - 0-30

- Semi-Monthly - 0-15

- ACCRUAL

DEFERRAL DAYS

This field is the number of days AFTER payment due day that the lease should be accrued for the following month. For example, if this field is set to10 days, cycle accruals run every day, and today is the eleventh, LeasePak will accrue today leases due on the first of next month.

The Month End Accrual Invoicing enhancement will accrue and invoice based on the numbers entered in the above fields, Invoicing Deferral Days and Accrual Deferral Days.

In order for the NUMBER OF DAYS FOR ADVANCED INVOICES switch in Lease Form [U0721] to perform correctly, the above two fields must be set to 0.

The exact day will be based on:Day of Accrual = invoice due day + accrual deferral days

Day of Invoice = invoice due day + invoicing deferral daysExample of behavior is as follows:

A lease has a due date of the 31st, Accrual Deferral is set to 0, than lease will always be included in EOM accrual regardless of the number of days in each month.

If a lease has a due date of the 20th and the accrual deferral day is set to 11, than it will be included in EOM accrual on if the month has 31 days. For example, if End of Month is submitted on April 25, accruals will run through April 30th. The accrual for this lease will not be picked up until May 1st.

For more details on number of days to be deferred and invoiced depending on the accrual/billing cycles defined, refer to Alternate Accrual/Billing Cycle.

Following table illustrates the deferral days with invoice due date for different type of accrual/billing cycles.

When Accrual Deferred Day = 0

Monthly Invoice Due Accrued On 1/1/2018 12/1/2017 2/1/2018 1/1/2018 3/1/2018 2/1/2018 4/1/2018 3/1/2018 5/1/2018 4/1/2018 6/1/2018 5/1/2018 7/1/2018 6/1/2018 Semi-Monthly Invoice Due Accrued On 1/1/2018 12/15/2017 1/15/2018 1/1/2018 2/1/2018 1/15/2018 2/15/2018 2/1/2018 3/1/2018 2/15/2018 3/15/2018 3/1/2018 4/15/2018 3/15/2018 Weekly Invoice Due Accrued On 1/1/2018 12/25/2018 1/8/2018 1/1/2018 1/15/2018 1/8/2018 1/22/2018 1/15/2018 1/29/2018 1/22/2018 2/5/2018 1/29/2018 2/12/2018 2/5/2018 Bi-Weekly Invoice Due Accrued On 1/1/2018 12/18/2017 1/15/2018 1/1/2018 1/29/2108 1/15/2018 2/12/2118 1/29/2018 2/26/2018 2/12/2018 3/12/2018 2/26/2018 3/26/2018 3/12/2018

When Accrual Deferred Day = 3

Monthly Invoice Due Accrued On 1/1/2018 12/4/2017 2/1/2018 1/4/2018 3/1/2018 2/4/2018 4/1/2018 3/4/2018 5/1/2018 4/4/2018 6/1/2018 5/4/2018 7/1/2018 6/4/2018 Semi-Monthly Invoice Due Accrued On 1/1/2018 12/18/2017 1/15/2018 1/4/2018 2/1/2018 1/18/2018 2/15/2018 2/4/2108 3/1/2018 2/18/2018 3/15/2018 3/4/2018 4/15/2018 3/18/2018 Weekly Invoice Due Accrued On 1/1/2018 12/28/2018 1/8/2018 1/4/2018 1/15/2018 1/11/2018 1/22/2018 1/18/2018 1/29/2018 1/25/2018 2/5/2018 2/1/2018 2/12/2018 2/8/2018 Bi-Weekly Invoice Due Accrued On 1/1/2018 12/21/2017 1/15/2018 1/4/2018 1/29/2018 1/18/2018 2/12/2018 2/1/2018 2/26/2018 2/15/2018 3/12/2018 3/1/2018 3/26/2018 3/15/2018

- TAX RATE%

Enter or change the corporate tax rate. This rate is used in yield calculations by the Model Amortization report [R0109]. If the tax rate is 26%, enter 26.00000, not ___.26000

- BAD DEBT%

Enter or change the portfolio default for bad debt percentage. This percentage of the contract receivable is allocated to an allowance for bad debt reserve when a new lease is booked. (The percentage may be changed for individual leases in the Book Lease option of the New Lease update [U0101].) If the percentage is 2%, then enter _2.00000, not ___.02000.

- COMMISSION RATE%

Enter or change the commission rate for salespersons, if applicable. This rate times the net present value of the lease's payment stream (using the discount rate) is displayed on the Salesperson Commission report [R0204]. Do not enter a rate if this commission calculation is not applicable. If the rate is 6%, then enter _6.00000, not ___.06000.

- GRACE AMOUNT

Late charges are not assessed on delinquent balances less than or equal to this amount. Leases with delinquent balances less than or equal to this amount will not be considered delinquent by the Collections module.

- PMTS

TO ALLOW FIRST EXT / DEF

Enter or change the number of payments that will allow for the first payment extension or deferment.

- PMTS TO ALLOW BETWEEN NEXT

EXT. / DEF

Enter or change the number of payments that will allow for a next extension or deferment.

If a lease is not eligible for an extension, LeasePak will prompt the user and not allow an extension to be made until the lease meets the extension criteria. Only a user with Collection or Customer Service Supervisor security may override the eligibility if the lease does not meet the criteria.

Also, the Extension and Deferment eligibility switches are governed by the EXT/ DEF ELIGIBILITY (Y/N) switch in the Miscellaneous Customization option of the Custom General update [U0712].

- MAX PMT EXT/DEF ORP/FIN

Enter or change the maximum number of payments to extend or defer a lease based on whether the lease is an operating or finance lease.

- REVERSE EXT FEE TO SUSP Y/N

Enter Y or N for the extension reversal fee to be places in Suspense. When 'Y' is selected the extension fee will be placed in Suspense [U0109]. If 'N' is selected, the extension fee will be placed in cash.

The Payment Extension Reversal will reverse any paid extension fees. When the Cash Control module is purchased, LeasePak will allow for a new reversal by reason code to be entered for any paid extension fees. The payment extension/deferment can be reversed in the Payment Reversal or Batch Number Payment Reversal [U0102] updates.

- ALLOW RESCHDL RESIDUAL UPDATE

Y/N

Enter Y or N to allow for the new residual to be rescheduled.

If DEF is the selected adjustment method and the number of months to be deferred and the processing month has been entered, LeasePak will defer and reschedule the first payment if the last accrued to date is later than the processing month. When the deferment is a SKIP payment, LeasePak will readjust the payment schedule accordingly.

Additionally, the existing extension fee assessment will be used for the deferment fee.

- REVERSAL SUSPENSE LIMIT DAYS

- AUTO

SUSPEND DAYS

Enter or change the number of days to suspend a delinquent lease. The default value is 60 days.

This field will allow LeasePak to automatically suspend a lease that has become delinquent by the total number of days entered above. All income and/or contra income recognition will be suspended when the lease is delinquent past the number of days entered. LeasePak will place the account in NHLD status. This field will also work in conjunction with the RECOGNIZE SUSP INCOME AT TIME OF PAYMENT switch.

- AUTO

UNSUSPEND DAYS

Enter or change the number of days to unsuspend a delinquent lease. The default value is 30 days.

This field will allow LeasePak to automatically unsuspend a delinquent lease once income earnings have been re-instated. The activity status of the lease once unsuspended will be ANOR.

- ASSET

PERCENTAGE CALC METHOD (A/P)

This field is displayed when the Asset Percentage Calc Method (A/P/C) switch in the Miscellaneous Customization option of the Custom General [U0712] update, is set to C. This switch allows LeasePak to have an alternate percent of schedule calculation at the Portfolio level. When changing this, LeasePak displays the following warning message: "Warning: Changing the calc method to existing leases may produce inaccurate data". Exercise caution when using this option at this level for existing leases, it may produce inaccurate data.

- Enter 'A' to calculate the percent of schedule by Acquisition Cost.

- Enter 'P' to calculate the percent of schedule by Payment Amount.

LeasePak allows for an alternate calculation for percent of schedule based on the weighted share of the total payment amount. See EBV Payoff Method in the Calculations Document of the Reference Guide

LeasePak allows the user to change the asset payment amount in Rebook [U0116] and the percent of schedule used in the tax calculations, after the lease has been booked when the Asset Percentage Calc Method (A/P) field is set to P.

This does not affect the Asset Payment Amount field in Book Lease Update [U0101] and may not be changed unless in Rebook [U0116].

Cashier's Checks, Upfront Sales Tax, Delinquency Categories

This screen is used to establish or change miscellaneous parameter information for the portfolio.

- SESSION UPDATE USED (Y/N)

Check this box if sessions are used for the portfolio. Sessions provide operational and balancing control over transactions involving cash receipts, such as payments or new lease bookings. If sessions are used, an operator may not process payments greater than the amount assigned to his/her session. An associated session parameter, ASSIGN CASH DISBURSEMENTS THROUGH SESSION (Y/N), exists under the New Lease Customizations section. This allows control over cash disbursements (e.g., vendor payments, broker payments, etc.) through the session. Refer to the Session update [U0111] documentation for more information.

-

TRANSFER PAYMENT TRANSACTION TO HISTORICAL FILE (Y/N)

Check this box if payment information on the Transaction (RTX) file is to be transferred to the Historical Transaction (RHT) file by the Historical Payment/RTX Cleanup update [U0451] during End of Month. If unchecked, payment transaction information for previous months is no longer available once End of Month is run. This means that the Account Payment History report [R0909] reflects payments made in the current month and payment reversals are only possible on these transactions. The purpose of keeping this option unchecked is to reduce storage space occupied by historical information.

- WARNING MESSAGE FOR PAYMENT OF NON-DELINQUENT INVOICE (Y/N)

Check this box to display a warning message in the Payments update [U0102] informing the user that the invoice number entered to be paid is not the most delinquent invoice for the lease. This parameter does not restrict the user from applying a payment to an invoice that is not the most delinquent.

- LEASE FACTOR SWITCH (P/R)

Two type of lease factors are calculated by LeasePak: payment and rental income. Enter P if the lease factor should be calculated as a payment factor, R as a rental income factor. Refer to Application Screen/tab 9 of the Application update [U0801] for more information.

- DELINQUENCY REPORT INTERACTIVE WATCH CODE OR GRACE PERIOD (W/G)

Enter W if the lease's watch code should be used to determine delinquency for delinquency reports executed interactively. Enter G if the lease's grace period should be used.

- DELINQUENCY REPORT END OF PERIOD WATCH CODE OR GRACE PERIOD (W/G)

Enter W if the lease's watch code should be used to determine delinquency for delinquency reports executed from End of Period. Enter G if the lease's grace period should be used.

- PORTFOLIO STATUS REPORT WATCH CODE OR GRACE PERIOD (W/G)

Enter W if the lease's watch code should be used to determine delinquency for the Portfolio Status report [R0104]. Enter G if the lease's grace period should be used.

- DISBURSE UPFRONT SALES TAX (Y/N)

Check this box if LeasePak should disburse upfront sales tax through End of Period Use Tax Disbursal [U0449]. Upfront sales tax amounts will be disbursed when adding the asset through the Use Tax Disbursal report [U0449].

- ALTERNATE INSURANCE FOLLOW-UP REPORT (Y/N)

Check this box if LeasePak should generate an alternative Insurance Follow-up report [R0904]. The alternative report differs from the original in the following respects:

- lessee address is not printed

- asset serial number is replaced by the asset classification

Refer to the Insurance Follow-up report [R0904] documentation for report samples and field descriptions.

- ALTERNATE DELINQUENCY REPORT (Y/N)

Check this box if LeasePak should generate an alternate Delinquency report [R0601]. The alternate report differs from the original in the following respects:

- lessee's watch code is printed

- number of times delinquent and number of days delinquent columns are moved to the far right on the report

- maturity date is not printed

- interest due and assessment due amounts are not printed

- total due to current (including amounts not yet delinquent) is printed

Refer to Delinquency report [R0601] documentation for report samples and field descriptions.

- DELINQUENCY CATEGORY BOUNDARIES

These numbers control how aging and delinquency reports group outstanding receivables into certain categories or "buckets" (e.g., 1-30 days delinquent, 31- 60 days delinquent, etc.). As well as setting the necessary parameters for default de-securitization. Enter or change 6 delinquency category boundaries. Each number must be greater than the previous number. For example, enter 30, 60, and 90,120,180 to set up buckets of 1-30, 31-60, 61-90, 91-120, 121-180, and 181+.

- NUMBER OF MONTH BEFORE CLEANING UP CASHIER's CHECK RECORDS

Enter or change the number of months to wait before records in the rck Cashiers Check table are removed. Original check are required to be able o reverse the check or perform a chargeback. If the value is set to zero, LeasePak performs a clean up of all RCK table records that exist each time the clean-up is run and will not retain any RCK records. If the entered value is up to maximum of 99, LeasePak will not perform any clean-up and leaves all of the RCK records untouched.

- NUMBER

OF MONTHS TO WAIT BEFORE CLEANING UP LEASE LVL TRANSACTIONS

This field is no longer necessary. All lease level transactions are automatically updated by lease in the General Ledger. Therefore, no cleanup is necessary.

- NUMBER

OF DAYS TO WAIT BEFORE CLEANING UP LEASE RECORDS

Enter or change the number of days to wait before information on closed leases (e.g., Master Financial, Address, Demographic, etc.) is moved to historical lease file and removed from active lease files. The historical lease file contains major lease information components, such as financial numbers (original cost, residual, payoff amount, gain/loss, etc.), original payment schedule, address information, and dates (commencement, maturity, payoff, etc.). Refer to the Closed Lease Cleanup [U0419] description in the End of Period [U04] documentation for more information.

Original lease information is required to reverse payoffs or terminations, so a sufficient number of days should be entered to assure that needed reversals can be processed. Available computer storage space should also be considered when setting this parameter. If storage space is limited, a large number for this parameter would cause larger than necessary data files and file access delays.

- NUMBER

OF MONTHS TO WAIT BEFORE CLEANING UP HISTORICAL PAYMENT RECORDS

Enter or change the number of months before cleaning up the Payments Records of delinquent leases that have been reported to the Credit Bureau. TRW requires leases to be reported for at least 2 months. This function is performed during End of Period.

Additionally, when Transfer Payment Transactions to Historical File (Y/N) is set to Y, LeasePak along with lease/util 220 Historical RTX Clean-up, will allow the user to run the Historical Payments/RTX Clean-up [U0451] interactively, up to the entered date of this field. The RTX Clean-up update will run during end of month as scheduled.

- ASSESS LATE CHARGES TO LEASES LESS THAN 60 DAYS OLD (Y/N)

Check this box to assess late charges to leases newly booked within the last 60 days.

Grand Total Page Breaks, Miscellaneous Settings

This screen is used to select when page breaks occur in printing grand totals on reports. For example, if only company key is marked Y, then pages will break after grand totals for each company. This screen is also used to format how total lines for different key levels are displayed, and for several other miscellaneous parameters described below.

- GRAND TOTAL PAGE BREAKS PORTFOLIO (Y/N)

Check this box to cause a page break between each portfolio's grand totals. Uncheck to prevent page breaks.

- GRAND TOTAL PAGE BREAKS COMPANY (Y/N)

Check this box to cause a page break between each company's grand totals. Uncheck to prevent page breaks.

- GRAND TOTAL PAGE BREAKS REGION (Y/N)

Check this box to cause a page break between each region's grand totals. Uncheck to prevent page breaks.

- GRAND TOTAL PAGE BREAKS CUSTOMER (Y/N)

Check this box to cause a page break between each customer's grand totals. Uncheck to prevent page breaks.

- PRINT HEADING ABOVE KEYS (Y/N)

Check this box if, prior to summarizing the lowest key level on a grand totals page, a heading of all the higher keys that relate to this lower level key are to be printed. This may prove useful if the lower level keys fill up the first page of the grand totals, thus forcing the user to look at the next page before determining higher key levels.

Uncheck if grand totals without these key headers are to be printed. This may be easier to read.

For example, selecting this check box would cause grand totals to be printed as follows:

-

TOTAL

LEASESPORTFOLIO: 1, COMPANY: 1, REGION: 1 OFFICE : 1 1034 OFFICE : 2 934 - Uncheck this box if the same grand totals page to be printed as follows:

-

TOTAL

LEASESOFFICE : 1 1034 OFFICE : 2 934

- PRINT ROW TITLES OR NAMES (T/N)

Enter T to print the titles PORTFOLIO, COMPANY, REGION, and OFFICE (or aliases established for these terms) on the left hand side of reports. Enter N print the actual name of each portfolio, company, region, and office on the left hand side of the report. If N is selected, the name is truncated to fit in the available space of 6-10 characters, if necessary.

For example, selecting T would cause the titles to be printed as follows:

| AMOUNT | ||||

| OFFICE | : | 2 | 120,993 |

- Uncheck this box would cause the names to be printed as follows:

| AMOUNT | ||||

| OAKLAN | : | 2 | 120,993 |

- INDENT TOTALS (Y/N)

Check this box to print different key levels with indentation to aid legibility. This may limit the space available for printing row names from a maximum of 10 characters to 6 characters, if the above PRINT ROW TITLES OR NAMES parameter is unchecked.

Uncheck this option to print key levels without indentation. This may be preferred when the PRINT HEADING ABOVE KEYS parameter is selected.

For example, selecting this check box would cause the grand total lines to be indented:

| TOTAL LEASES |

||||

| SANTA BARBARA | : | 1 | 1034 | |

| SANTA FE | : | 2 | 934 | |

| WEST COAST | : | 1 | 1968 | |

| NETSOL TECHNOLOGIES | : | 1 | 1968 |

- Clear the check box to print the grand total lines without indentation:

| TOTAL LEASES |

||||

| SANTA BARBARA | : | 1 | 1034 | |

| SANTA FE | : | 2 | 934 | |

| WEST COAST | : | 1 | 1968 | |

| NETSOL TECHNOLOGIES | : | 1 | 1968 |

- ALLOW PREPAYMENTS WITH OUTSTANDING ASSESSMENTS (Y/N)

This switch governs the Payment and Enhanced Payment options of the Payment update [U0102]. Clear the check box to present the oldest open invoice for payment on the Payment option, whatever type of receivable is still open.

Select the check box to present the oldest invoice with normal payment open on the Payment option. Warning messages alert the user that older invoices exist with assessments still unpaid. If all normal payments have been satisfied, LeasePak allows the user to apply cash as a credit memo on the Payment or Enhanced Payment option, even with assessments on the lease unpaid.

- ADD COMMENT TO TRANSACTIONS (Y/N)

With Add Comment to Transaction Record (part of the JULE Fund 1996 package), the ADD COMMENT TO TRANSACTIONS switch is displayed on the screen.

This switch allows the user to enter COMMENTS within certain General Ledger updates, allowing the user to create an audit trail for a specified lease. When the switch is checked, the user is allowed to enter a COMMENT in the following updates:

- Payments [U0102]

- General Ledger Adjustment [U0121]

- IBL Principal Adjustment [U0125]

The COMMENT entered in the above updates is displayed in the following reports:

- Daily Transaction Journal [R0405]

- Cash Receipts Journal [R0411]

- Account Payment History [R0909]

The Payment [U0102] update, allows the user to enter a comment regardless of the switch settings.

- NOTE TYPE USED IN CREDIT APPROVAL REPORT

The Credit Approval [R0506] report can display comments taken from the notebook. This parameter identifies the type of notes that will be picked up for the [R0506]. Use Help for a list of valid note types.

- DEFAULT DISPLAY OF PAYMENT AMOUNT

This switch governs the Payment and Enhanced Payment options of the Payment update [U0102]. Check this box to display the default "TOTAL AMOUNT" due and the "AMT TO APPLY" fields for the selected lease on the payment screens. Clear the box for the payment amount due not to default in the "TOTAL AMOUNT" and the "AMT TO APPLY" fields of the payment screens. Clear check box, it will allow the user to manually enter the payment amount remitted.

With Default Display of Payment Amount (part of the JULE Fund 1996 package), the DEFAULT DISPLAY OF PAYMENT AMOUNT switch is displayed on the screen.

- PRINCIPAL/PAYMENT

INTEREST WAIVER BANK CODE

This field allows the user to enter the BANK CODE to which the assessment waived will be paid.

The BANK CODE value must be 1, 125-144, or 499-520. The Multiple Banks module must be purchased. If the module is not purchased, this field will not be displayed.

- DOWN PAYMENT IS INFORMATIONAL ONLY (Y/N)

This switch governs the Down Payment field to be informational only or not.

When Y is entered, the dollar amount entered in the down payment field of the Book Lease [U0101] update, Rebook [U0116] update or the Application tabs [U0801], will not have an impact on yield calculations, invoices, payments or G/L transactions.

The informational down payment dollar amount entered will be displayed in the Lease Inquiry [R0905] the Application Inquiry [R0502] and the Model Amortization [R0109].

When the Vehicle Finance module is purchased, the Informational Down Payment amount entered will display as the TOTAL DOWN PAYMENT in the R0905, R0502 and the R0109 reports. The vehicle Trade-in information such as MAKE, MODEL, GROSS ALLOWANCE and CASH DOWN information will appear on the reports as well.

- RECOGNIZE SUSP INCOME AT TIME OF PAYMENT (Y/N)

This switch works in conjunction with the Auto Suspended Earning [U0439] update.

Check this box for all suspense income to be recognized at the time of payment. When this box is selected and an account is in a suspended status all income and contra income will be recognized on a cash basis as payments are applied.

Clear the box for suspense income not to be recognized at time of payment.

- AUTO BATCH PAYOFF FOR IBL BATCH PAYMENT SUSPENSE (Y/N)

This option is accessible if the Cash Control, Batch Payment Processing, Batch Payoff Processing, and Loan Accounting modules are purchased. Check the box, allows the Batch Payments program to create a batch payoff detail record using the suspense item if it encounters an exception while processing an 'A' method, 'RAX*' IBL batch payment. The resultant batch payoff detail record will then be used by the Batch Payoff program to automatically payoff the affected IBL (interest bearing loan). For more information, refer to Batch Payments [U0305] and Batch Payments [U415].

- DELINQUENT PAYMENT INCLUDES TAX

Check this box for the delinquency percentage, in the previous field, to calculate the principal, interest and sales tax portion of the account receivable record. Clear the check box for delinquency percentage to be based on the principal and interest portion only.

Late charge methods PERC, PMAX, PMIN and FIX calculate and determine late charges on the most current account receivable record. Once it has been determined that the account receivable is delinquent and a late charge has been applied, LeasePak will not calculate late charges on the same account receivable record.

Also, late charge methods OUTP, OUTP and PCON are the only late charge methods that take into account all open account receivable records to determine the late charge.

And, the Delinquency Percentage calculation fields do not support GF** late charge methods.

- DEALER REMITTANCE BANK CODE

Enter the Dealer Remittance Bank Code. The default value is 126. The bank code entered will allow LeasePak to track new IDC/IDR activities as well as any accounting between the dealer and the lessor as well as provide a Dealer Statement [U0426] report during End of Period.

This field is only accessible when the Enhanced IDC/IDR module is purchased.

- CHANGE DEPRECIATION AT TERM (Y/N)

This field allows the ability to change the depreciation method of all the assets on a lease during U0103 Termination and/or U0108 Auto Lease Extension and U0108 Lease Extension. Finance assets associated with the lease become operating assets. Check the box to allow the depreciation to be modified. Additionally, R1001 Used Inventory, Report B of R1001 Off Lease Inventory, will display the asset detail information.

This check will not allow changes to U0120 Change Asset fields "Book Depreciation Start Date" and "Book Depreciation Basis" for terminated or extended assets.

If CHANGE DERPRECIATION AT TERM check box is selected and switch Prorate INC, IDC.IDR, DEPR option is also selected then LeasePak will not pro-rate depreciation and prompts the following warning message:

Determine how you want to set this when first configuring the portfolio, then DO NOT CHANGE IT. Attempting to change this after the portfolio has been in use may result in serious data corruption. Check this box, whether or not you take advantage of the feature, will provide the most flexibility later in remarketing assets. NetSol is not responsible for data corruption incurred by changing this setting after the portfolio is in use. Contact your NetSol representative for more information.

Determine how you want to set this when first configuring the portfolio, then DO NOT CHANGE IT. Attempting to change this after the portfolio has been in use may result in serious data corruption. Check this box, whether or not you take advantage of the feature, will provide the most flexibility later in remarketing assets. NetSol is not responsible for data corruption incurred by changing this setting after the portfolio is in use. Contact your NetSol representative for more information. Vehicle Finance users: This field is not accessible with the Vehicle Finance module.

Vehicle Finance users: This field is not accessible with the Vehicle Finance module.

- PRINCIPAL PAY DOWN

Check this box for all overpayments received on IBL accounts to be applied to Principal Paydown, if no account receivable records are found. This enhancement works in conjunction with the Cash Control [U0126] module and with the IBL A or B BEHAVIOR switch in Custom General [U0712] set to A.

Clear the box for overpayments received to be applied to Suspense, if no account receivable records are found.

If the Write Down amount is greater than the Outstanding Principal, the Outstanding Principal will be paid and the remaining amount will be used to create a Suspense item.

The default value is N (No).

Clear the box, the default value, is standard LeasePak functionality. LeasePak will create a Suspense item for extra money received on IBL accounts.

- PRORATE INCOME IDC/IDR

This field works in conjunction with the Prorate Income module, a separately purchased module. Additionally, this field requires the Accrual Deferral Days Days field to be set to '0'. The default value of this field is 'N' (No).

Check this box prorate finance or operating income IDC/IDR based on the number of days the lease or asset is active for a specific month.

If PRORATE INCOME IDC/IDR check box is selected and switch CHANGE DERPRECIATION AT TERM is also selected, then LeasePak will not pro-rate depreciation and prompts the following warning message:

It is recommended that this switch must be selected only when adding a new Portfolio or if there are no active leases on the Portfolio. This allows for Accrual and Accrual Reversals to process correctly.

- PRORATE DEPRECIATION

This field works in conjunction with Prorate Income IDC/IDR. To use this field, the user must select the Prorate Income IDC/IDR field. The default value of this field is 'N'(No). This field determines whether or not to prorate book depreciation. Selection of this field prorates the book depreciation if the book depreciation method is supported with the prorate income module. Users must own Prorate Income module to use this field.

- VERIFY SUM OF PAYMENTS

This field verifies that the Total Amount entered in the Payment Schedule and the Sum of Payments fields are equal in value when a lease and/or application is being booked. An error message will be displayed and the lease will not be processed until the Sum of Payments match. Check this box to verify the Sum of Payments. When the box is clear, LeasePak will not perform this edit check.

- IRR USE IN FASB 13 TEST (A/B/C)

This field allows the user to select the rate to be used as the implicit rate in performing the FASB 13, 90% present value test. The FASB 13 test is used to determine if the contract in Applications [U0801], is a Finance or Operating type lease. Select the rate to be used, the default is 'A'.- A = Yield

- B = IRR with Residual

- C = IRR without Residual

- ACCRUE IBL INTERST AFTER MATURITY

This field works with IBL method B only. Select the check box to continue calculating interest even after maturity date of a lease or a loan even if the last invoice is not fully paid and the IBL is in "NMAT" status or in "Nxxx" suspense earning status. By default this field is set to No. It will default to Yes if Custom General, IBL Payment Method is B, else the field will by default set to No and disabled. This field will not work with vehicle finance module.

- ALLOW PERMANENT TAX RATE CHANGE

This field is used to change tax rate for assets with use tax code of PERM.

- COPY LP CHECK NUMBER TO BANK CHECK NUMBER

This field is used to copy LeasePak check number to bank check number when processing U0117 Cashier's Check Disbursal.

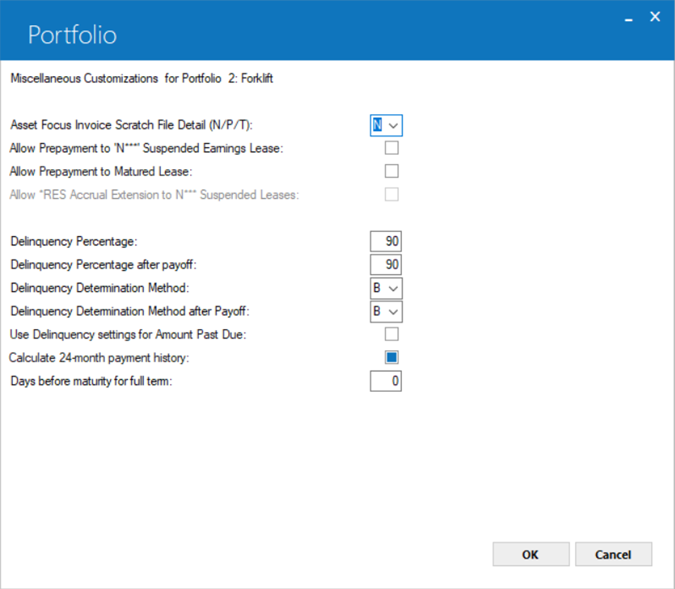

Asset Focus, Suspended Earnings, Dealer Settings

Asset Focus Invoice Scratch File Detail (N/P/T)

Asset Focus Invoice Scratch File Detail (N/P/T)-

(Optional)

Specifies whether to include asset detail information of past due invoices in the Cycle Invoices [U0302] scratch file. The setting also specifies the method to use for applying the payment to the past due invoices for Asset Focus assets. The possible switches for this setting are: N, P and T.

N (Not Display) - This is the default switch for this setting. The 'N' switch indicates not to include the asset level invoice detail in the scratch file. Under this selection, LeasePak uses the Prorate method for the calculation of remaining payable amount for each asset.

P (Prorate) - Indicates to use the Prorate method for applying the partial payment amount to the assets of an Asset Focus lease. The Prorate method calculates the payable amounts for assets based on the percentage of their Payment Amounts to the Payment Amount of lease with which they are attached. The detail of the asset level invoice is included in the Cycle Invoices [U0302] scratch file.

T (Top Down) - This switch indicates LeasePak to use the Top Down method for applying partial payment amount to the assets. In the Top Down approach, LeasePak applies the partial payment amount to the assets according to their attachment sequence. For any payment amount entered, LeasePak applies it to the first asset of the lease until it is zeroed out and then continues the same with next asset in the sequence until all payments are cleared out.

Asset Focus Invoice Scratch File Detail (N/P/T)

Asset Focus Invoice Scratch File Detail (N/P/T)N (Not Display) - This is the default switch for this setting. The 'N' switch indicates not to include the asset level invoice detail in the scratch file. Under this selection, LeasePak uses the Prorate method for the calculation of remaining payable amount for each asset.

P (Prorate) - Indicates to use the Prorate method for applying the partial payment amount to the assets of an Asset Focus lease. The Prorate method calculates the payable amounts for assets based on the percentage of their Payment Amounts to the Payment Amount of lease with which they are attached. The detail of the asset level invoice is included in the Cycle Invoices [U0302] scratch file.

T (Top Down) - This switch indicates LeasePak to use the Top Down method for applying partial payment amount to the assets. In the Top Down approach, LeasePak applies the partial payment amount to the assets according to their attachment sequence. For any payment amount entered, LeasePak applies it to the first asset of the lease until it is zeroed out and then continues the same with next asset in the sequence until all payments are cleared out.

ALLOW PREPAYMENT TO 'N***' SUSPENDED EARNINGS LEASE

ALLOW PREPAYMENT TO 'N***' SUSPENDED EARNINGS LEASE-

(Optional)

This option appears inactive if the Cash Control module is purchased. Check this box to allow prepayments for all non-matured 'N***' suspended earning leases.

The option affects leases in one of the following suspended earning statuses:

- NH01 - Suspended Earnings: Foreclosure

- NH02 - Suspended Earnings: Insurance Claim

- NH03 - Suspended Earnings: Settlement

- NH04 - Suspended Earnings: Write Off

- NH07 - Suspended Earnings: Bankruptcy

- NH13 - Suspended Earnings: Bankruptcy

- NHLD - Suspended Earnings Hold

- NINS - Suspended Earnings Non-Insurance

- NREC - Suspended Earnings Rescission

- NREP - Suspended Earnings Involuntary Repossession

- NSET - Suspended Earnings Insurance Settlement

- NSKP - Suspended Earnings Skip

- NVOL - Suspended Earnings Voluntary Repossession

This option will not work with the Cash Control module.

ALLOW PREPAYMENT TO 'N***' SUSPENDED EARNINGS LEASE

ALLOW PREPAYMENT TO 'N***' SUSPENDED EARNINGS LEASEThe option affects leases in one of the following suspended earning statuses:

- NH01 - Suspended Earnings: Foreclosure

- NH02 - Suspended Earnings: Insurance Claim

- NH03 - Suspended Earnings: Settlement

- NH04 - Suspended Earnings: Write Off

- NH07 - Suspended Earnings: Bankruptcy

- NH13 - Suspended Earnings: Bankruptcy

- NHLD - Suspended Earnings Hold

- NINS - Suspended Earnings Non-Insurance

- NREC - Suspended Earnings Rescission

- NREP - Suspended Earnings Involuntary Repossession

- NSET - Suspended Earnings Insurance Settlement

- NSKP - Suspended Earnings Skip

- NVOL - Suspended Earnings Voluntary Repossession

This option will not work with the Cash Control module.

ALLOW PREPAYMENT TO MATURED LEASE

ALLOW PREPAYMENT TO MATURED LEASE-

(Optional)

This option appears inactive if the Cash Control module is purchased. Check this box to allow prepayments for all matured 'N***' suspended earning leases and 'NMAT' matured lease. Prepayments are not allowed for matured IBLs.

The option affects matured leases in 'NMAT' status or in one of the following suspended earning statuses:

- NH01 - Suspended Earnings: Foreclosure

- NH02 - Suspended Earnings: Insurance Claim

- NH03 - Suspended Earnings: Settlement

- NH04 - Suspended Earnings: Write Off

- NH07 - Suspended Earnings: Bankruptcy

- NH13 - Suspended Earnings: Bankruptcy

- NHLD - Suspended Earnings Hold

- NINS - Suspended Earnings Non-Insurance

- NREC - Suspended Earnings Rescission

- NREP - Suspended Earnings Involuntary Repossession

- NSET - Suspended Earnings Insurance Settlement

- NSKP - Suspended Earnings Skip

- NVOL - Suspended Earnings Voluntary Repossession

This option will not work with the Cash Control module.

ALLOW PREPAYMENT TO MATURED LEASE

ALLOW PREPAYMENT TO MATURED LEASEThe option affects matured leases in 'NMAT' status or in one of the following suspended earning statuses:

- NH01 - Suspended Earnings: Foreclosure

- NH02 - Suspended Earnings: Insurance Claim

- NH03 - Suspended Earnings: Settlement

- NH04 - Suspended Earnings: Write Off

- NH07 - Suspended Earnings: Bankruptcy

- NH13 - Suspended Earnings: Bankruptcy

- NHLD - Suspended Earnings Hold

- NINS - Suspended Earnings Non-Insurance

- NREC - Suspended Earnings Rescission

- NREP - Suspended Earnings Involuntary Repossession

- NSET - Suspended Earnings Insurance Settlement

- NSKP - Suspended Earnings Skip

- NVOL - Suspended Earnings Voluntary Repossession

This option will not work with the Cash Control module.

ALLOW *RES ACCRUAL EXTENSION TO 'N***' SUSPENDED LEASES

ALLOW *RES ACCRUAL EXTENSION TO 'N***' SUSPENDED LEASES-

(Optional)

This option appears inactive if the Cash Control module is purchased. Check this box to allow extensions and their reversals on matured 'N***' suspended earning leases using an 'RES' Residual extension with an '*RES' accrual method. Extensions are not allowed on interest bearing loans (IBLs).

The option allows extension of suspended leases in the following statuses:

- NH01 - Suspended Earnings: Foreclosure

- NH02 - Suspended Earnings: Insurance Claim

- NH03 - Suspended Earnings: Settlement

- NH04 - Suspended Earnings: Write Off

- NH07 - Suspended Earnings: Bankruptcy

- NH13 - Suspended Earnings: Bankruptcy

- NHLD - Suspended Earnings Hold

- NINS - Suspended Earnings Non-Insurance

- NREC - Suspended Earnings Rescission

- NREP - Suspended Earnings Involuntary Repossession

- NSET - Suspended Earnings Insurance Settlement

- NSKP - Suspended Earnings Skip

- NVOL - Suspended Earnings Voluntary Repossession

This option will support the Asset Focus Module (AFM) but not work with the Cash Control module.

ALLOW *RES ACCRUAL EXTENSION TO 'N***' SUSPENDED LEASES

ALLOW *RES ACCRUAL EXTENSION TO 'N***' SUSPENDED LEASESThe option allows extension of suspended leases in the following statuses:

- NH01 - Suspended Earnings: Foreclosure

- NH02 - Suspended Earnings: Insurance Claim

- NH03 - Suspended Earnings: Settlement

- NH04 - Suspended Earnings: Write Off

- NH07 - Suspended Earnings: Bankruptcy

- NH13 - Suspended Earnings: Bankruptcy

- NHLD - Suspended Earnings Hold

- NINS - Suspended Earnings Non-Insurance

- NREC - Suspended Earnings Rescission

- NREP - Suspended Earnings Involuntary Repossession

- NSET - Suspended Earnings Insurance Settlement

- NSKP - Suspended Earnings Skip

- NVOL - Suspended Earnings Voluntary Repossession

This option will support the Asset Focus Module (AFM) but not work with the Cash Control module.

DELINQUENCY PERCENTAGE:

DELINQUENCY PERCENTAGE:-

The percentage entered will determine when an A/R record is considered delinquent based upon the amount applied to the principal, interest, and assessment charges indicated as part of delinquency calculation of the record. If the amount applied meets the Delinquency Percentage entered, then the A/R record will not be delinquent. When the amount applied does not meet the Delinquency Percentage entered, the A/R record will be considered delinquent.

When the Vehicle Finance module is purchased, the Delinquency Percentage entered will affect how late charges are applied as well as, how the Delinquency Categories entered will update the lease information.

Late Charges are applied if the A/R record does not meet the percentages entered in the Delinquency Percentage field and/or the SUPRESS LATE FEE IF PAYMENT % fields entered in the Lease Form Code [U0721], when the Vehicle Finance module is purchased.

DELINQUENCY PERCENTAGE:

DELINQUENCY PERCENTAGE:When the Vehicle Finance module is purchased, the Delinquency Percentage entered will affect how late charges are applied as well as, how the Delinquency Categories entered will update the lease information.

Late Charges are applied if the A/R record does not meet the percentages entered in the Delinquency Percentage field and/or the SUPRESS LATE FEE IF PAYMENT % fields entered in the Lease Form Code [U0721], when the Vehicle Finance module is purchased.

DELINQUENCY PERCENTAGE AFTER PAYOFF:

DELINQUENCY PERCENTAGE AFTER PAYOFF:-

This field works same as "Delinquency Percentage", only for paid off or terminated leases. The field accepts only integer type whole number percentages (such as 83 or 95). Fractional percentages (such as 66.67 or 83.34) are not allowed.

DELINQUENCY PERCENTAGE AFTER PAYOFF:

DELINQUENCY PERCENTAGE AFTER PAYOFF:

DELINQUENCY DETERMINATION METHOD:

DELINQUENCY DETERMINATION METHOD:-

This field is an identifier to determine the delinquency method when determining delinquency and calculating amount past due. Following are the possible three options to select and identify the delinquency determination method:

- A - Principal and Interest

- B - Principal, Interest, and Sales Tax

- C - Principal, Interest, and Assmt. delq. Switches

If delinquency determination method is set to C, LeasePak will use the U0212 Assessment Customization Delq (Y/N) switch to determine which charges to include in the delinquent amount. If the value is set to A then principal and interest will be used. If the value is elected as B that means just principal, interest, and sales tax will be used.

DELINQUENCY DETERMINATION METHOD:

DELINQUENCY DETERMINATION METHOD:- A - Principal and Interest

- B - Principal, Interest, and Sales Tax

- C - Principal, Interest, and Assmt. delq. Switches

If delinquency determination method is set to C, LeasePak will use the U0212 Assessment Customization Delq (Y/N) switch to determine which charges to include in the delinquent amount. If the value is set to A then principal and interest will be used. If the value is elected as B that means just principal, interest, and sales tax will be used.

DELINQUENCY DETERMINATION METHOD AFTER PAYOFF:

DELINQUENCY DETERMINATION METHOD AFTER PAYOFF:-

This switch works same as Delinquency Determination Method switch but applies to invoices due on or after the payoff or termination effective date.

DELINQUENCY DETERMINATION METHOD AFTER PAYOFF:

DELINQUENCY DETERMINATION METHOD AFTER PAYOFF:

USE DELINQUENCY SETTINGS FOR AMOUNT PAST DUE:

USE DELINQUENCY SETTINGS FOR AMOUNT PAST DUE:-

This field is used to have either Miscellaneous Customizations or Assessment Customizations settings to control Amount Past Due for credit bureau reporting.

Check the box to set it to have LeasePak use the same values used to determine if the lease is delinquent when calculating amount past due or leave unchecked to set it to 'N' to have LeasePak use the total amount billed (tamt_b_d) less the total amount paid (tamt_p_d). The amount past due will only be calculated and populated if the lease account status being reported that month is not '11' indicating current. This setting just indicates what values to use when calculating the amount past due value, not making the delinquency determination.

LeasePak stores this field value in delq_pastdue_c column of table rpa Portfolio (overflow).

USE DELINQUENCY SETTINGS FOR AMOUNT PAST DUE:

USE DELINQUENCY SETTINGS FOR AMOUNT PAST DUE:Check the box to set it to have LeasePak use the same values used to determine if the lease is delinquent when calculating amount past due or leave unchecked to set it to 'N' to have LeasePak use the total amount billed (

tamt_b_d) less the total amount paid (tamt_p_d). The amount past due will only be calculated and populated if the lease account status being reported that month is not '11' indicating current. This setting just indicates what values to use when calculating the amount past due value, not making the delinquency determination.

LeasePak stores this field value in

delq_pastdue_c column of table rpa Portfolio (overflow).

CALCULATE 24-MONTH PAYMENT HISTORY (Y/N):

CALCULATE 24-MONTH PAYMENT HISTORY (Y/N):-

For use in conjunction with the Metro2 credit bureau function. Check this box to calculate the payment history. For more

information, refer to Metro2 Setup [U0733].

CALCULATE 24-MONTH PAYMENT HISTORY (Y/N):

CALCULATE 24-MONTH PAYMENT HISTORY (Y/N):

DAYS BEFORE MATURITY FOR FULL TERM:

DAYS BEFORE MATURITY FOR FULL TERM:-

Enter the number of days before a lease(s) maturity date that payoff or termination can be considered full-term. This tolerance will determine that whether the payoff/termination is reported to the credit bureau as early or full-term. This field takes day's maximum value upto 366.

Credit Bureau Extract users: If user enters an "Asset(s) Return Date" through U0239 Credit Bureau Lease prior to the payoff/termination, that date will be used for the comparison date. If user does not enter an "Asset(s) Return Date", the payoff/termination, the "Effective Date" than LeasePak uses that for the comparison date. Otherwise, the payoff/termination will be reported as early term.

Credit Bureau Extract users: If user enters an "Asset(s) Return Date" through U0239 Credit Bureau Lease prior to the payoff/termination, that date will be used for the comparison date. If user does not enter an "Asset(s) Return Date", the payoff/termination, the "Effective Date" than LeasePak uses that for the comparison date. Otherwise, the payoff/termination will be reported as early term.

DAYS BEFORE MATURITY FOR FULL TERM:

DAYS BEFORE MATURITY FOR FULL TERM: Credit Bureau Extract users: If user enters an "Asset(s) Return Date" through U0239 Credit Bureau Lease prior to the payoff/termination, that date will be used for the comparison date. If user does not enter an "Asset(s) Return Date", the payoff/termination, the "Effective Date" than LeasePak uses that for the comparison date. Otherwise, the payoff/termination will be reported as early term.

Credit Bureau Extract users: If user enters an "Asset(s) Return Date" through U0239 Credit Bureau Lease prior to the payoff/termination, that date will be used for the comparison date. If user does not enter an "Asset(s) Return Date", the payoff/termination, the "Effective Date" than LeasePak uses that for the comparison date. Otherwise, the payoff/termination will be reported as early term.

CALCULATE 24-MONTH PAYMENT HISTORY

CALCULATE 24-MONTH PAYMENT HISTORY-

For use in conjunction with the Metro2 credit bureau function. Check this box to calculate the payment history. For more information, refer to Metro2 Setup [U0733].

CALCULATE 24-MONTH PAYMENT HISTORY

CALCULATE 24-MONTH PAYMENT HISTORY