U0212 Portfolio

Modules Customizations

Module Settings

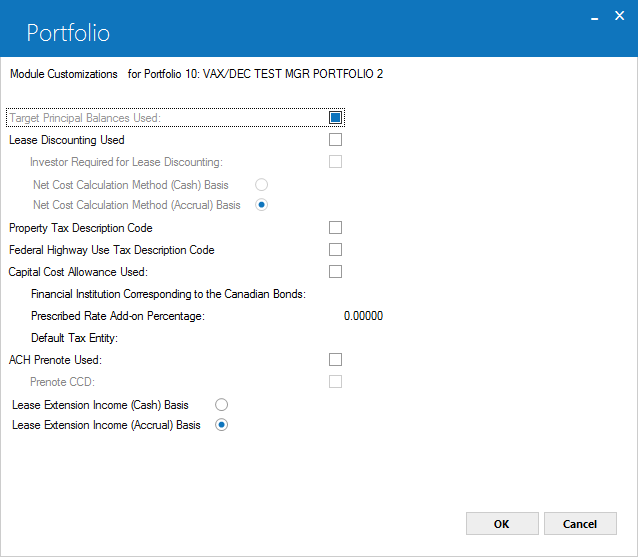

This screen is used to establish or change parameters associated with the Loan Accounting, Lease Discounting, Property Tax Description, PAP/Preauthorize Pmts and Lease Extensions modules.

These are optional modules that may be purchased separately and added on to the LeasePak base system. This screen appears only if one or more of the optional modules is purchased.

Field Descriptions

- TARGET

PRINCIPAL BALANCES USED:

If the Loan Accounting module is used, check the box if target principal balances should be established for interest bearing loans. Otherwise, uncheck the box. Target principal balances are used by the Cycle Accrual update to compare the net outstanding balance (after the accrual) with a target principal level. If the net outstanding balance is greater than the target principal level, a message is written to the Accrual Message report [U0301D].

This field is accessible only if the Loan Accounting module has been purchased.

- LEASE

DISCOUNTING USED:

Check this box if the Lease Discounting module is used for this portfolio; otherwise, uncheck the box.

Bowfront VAT is not compatible with Lease Discounting. If the UPFRONT TAX switch is selected on the New Lease screen of [U0212], the LEASE DISCOUNTING USED switch must be unchecked.

If Lease Discounting is used, then leases associated with the portfolio will not be allowed in the Suspended Earnings [U0115] option. If leases in the portfolio are suspended, LeasePak will not allow the switch to be selected. All General Ledger names associated with suspended transactions should be modified to names more suitable for Lease Discounting through Office G/L Change update [U0716]. The following is a list of general ledger names for suspended transactions and suggested names for lease discounting:

| SUSPENDED G/L NAMES | SUGGESTED LEASE DISCOUNTING G/L NAMES |

| SUSPENDED RECEIVABLE (INCOME) | DISCOUNTED PAYABLE (INCOME) |

| SUSPENDED RECEIVABLE (PRINCIPAL) | DISCOUNTED PAYABLE (PRINCIPAL) |

| SUSPENDED INCOME RECEIVABLE (UNBILLED) | DISCOUNTED INCOME PAYABLE (UNBILLED) |

| SUSPENDED INCOME ACCRUED | DISCOUNTED INCOME ACCRUED |

This field is accessible only if the Lease Discounting module has been purchased.

- INVESTOR REQUIRED FOR LEASE

DISCOUNTING:

Check this box if INVESTOR is an input-required field in the Lease Discounting module for this portfolio; otherwise, uncheck the box.

This field is accessible only if the Lease Discounting module has been purchased and lease discounting is used in the portfolio.

- NET

COST CALC METHOD (A/C)

The Net Cost of the discounted lease may be calculated in two ways. If an A is entered the formula is as follows: Original Acq Cost - Down Pymt - Earned Income. When this switch is set to C, the calculation will be: Contract Rec - Unearned Income. See the Lease Discounting update [U0123] for more information on this calculation.

This field is accessible only if the Lease Discounting module has been purchased and lease discounting is used in the portfolio.

- PROPERTY

TAX DESCRIPTION CODE

Check this box if the Property Tax Description code is used for this portfolio; otherwise, uncheck the box.

This field is accessible only if Property Tax Description module has been purchased.

- ESTIMATED PROPERTY TAX DESCRIPTION

CODE

Check this box if the Estimated Property Tax Description code is used for this portfolio; otherwise, clear the box. This custom code is set up to track estimated property tax in the same manner as the actual property tax.

This custom code is renamed from the Federal Highway Use Tax (FHUT) assessment code. If the estimated property tax description code is used, FHUT will not be used.

This field is accessible only if Property Tax Description module has been purchased.

- ACH

PRENOTE USED

Check this box if the PAP/Preauthorize Pmts module is purchased and Prenotifications are used. Otherwise, clear the box.

- PRENOTE CCD

In the U.S. PAP/ACH payments are coded CCD, as opposed to PPD. Check this box if Prenotifications should be used to CCD Standard Entry Class Code. Otherwise, clear the box.

- LEASE EXTENSION INCOME BASIS (A/C)

Enter A for Accrual or C for Cash. This value will be used as the default on Lease Extension [U0108]. It may be overridden for an individual lease, if desired.

With the A-accrual option, as lease payments are billed and accrued after the lease has been extended, unguaranteed residual is reduced to zero, then residual income is recognized.

When this field is set to A, LeasePak will allow Lease Extensions [U0108], on leases with the OPR methods, to recognize income on a cash basis. When the OPR is entered in the Extension Method field.

With the cash option, residual reduction and residual income are not recognized until cash has actually been received and applied to an open invoice.

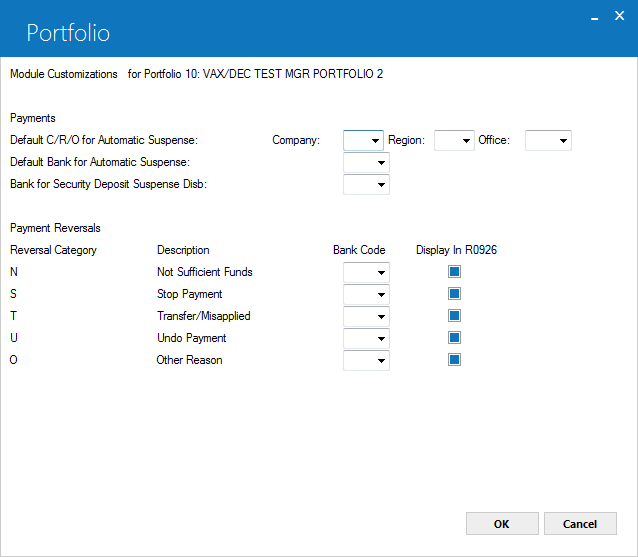

Automatic Suspense/Payoff, Payment Reversals

This screen will appear when the Cash Control and Multiple Bank modules are purchased.This screen is used to establish or change parameters associated with the Cash Control module for Payments and the Batch Number Payment Reversals update, as well as the Cash Control Payment History [R0926] report.

The Custom Codes update [U0722] will require Reversal by Reason Codes to begin with N,S, T, U, or O.

Field Descriptions

- DEFAULT

C/R/O FOR AUTOMATIC SUSPENSE

Enter the Company, Region, Office for automatic suspense. Use Help to display a list of C/R/O's. This field is input required.

- DEFAULT

BANK FOR AUTOMATIC SUSPENSE

Enter the default bank code for automatic suspense. Use Help to display a list of valid

bank codes. This field is input required.

to display a list of valid

bank codes. This field is input required.

- BANK FOR AUTOMATIC SECURITY DEPOSIT SUSPENSE DISBURSAL

Specify the bank number (G/L account number) that the Auto Security Deposit Suspense Disbursal [U0436] update (End of Period, End of Day) will use to disburse security deposit suspense items that meet the requirements for disbursal. Refer to one of the following documents for more information:- Payments [U0102]: Batch Number Payment Reversal

- Payoff [U0103]: Payoff, Payoff Reversal

- Payoff [U0103]: Termination, Termination Reversal

- Security Deposit Disbursal [U0408], part of End of Period [U04]: Daily Updates

- AUTOMATIC

PAYOFF LOSS TOLERANCE

Enter the payoff loss tolerance amount for the P/C/R/O.

- AUTOMATIC

PAYOFF GAIN TOLERANCE

Enter the payoff gain tolerance for the P/C/R/O.

- REVERSAL

CATEGORY

This column displays the reversal categories for payment reversals. This field is view only.

- DESCRIPTION

This column displays the description for the reversal categories. These are view only.

- BANK CODE

Enter the bank code that applies to each reversal category. Use HELP for a list of valid

Bank Codes. This is a required field.

for a list of valid

Bank Codes. This is a required field.

- DISPLAY

IN R0926

Check this box to view each reversal category in the Cash Control Payment History [R0926] report. This will allow the user to view any reversal categories associated with the lease, as well as provide a trace reference code.

When the box is unchecked, LeasePak will hide payment and payment reversal transactions on the Cash Control Payment History report.

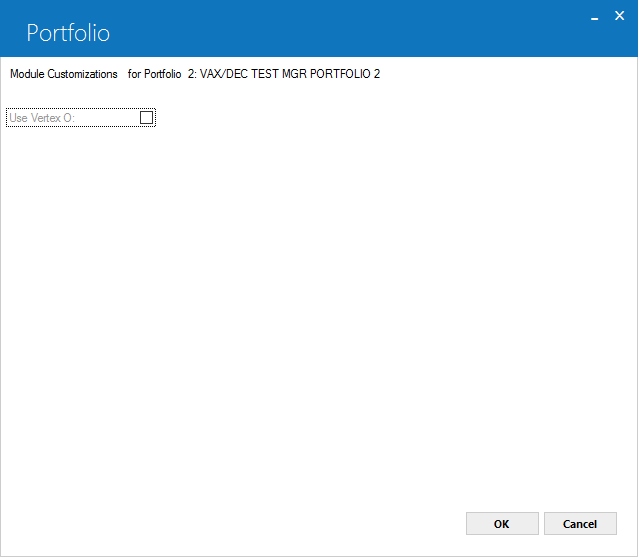

Vertex O Series

Vertex O Series: This screen and the fields on it apply to Vertex O Series users only.

Vertex O Series: This screen and the fields on it apply to Vertex O Series users only.

- Use Vertex O:

Check this box to indicate that the selected portfolio allows the use of Vertex O to calculate sales and use tax. If it is unchecked than, all leases in the selected portfolio will use the standard LeasePak tax calculations with the rates stored in LeasePak database RLO Location table.

Before setting switch, Use Vertex O to Yes users must first select U0712 Custom General Vertex O switch to Yes to enable U0212 Portfolio settings.

Users cannot change switch Use Vertex O from Yes to No if any leases attached to the current portfolio are Vertex O leases or if the EOP modules Vertex O Disbursal and Vertex O Journal are turned on.