Accounts Receivable Balancing [R0404]

End of Period: This process can be run either interactively through this update or seleted to run as a special month-end version during EOP End of Month. As an EOP module, the process is:

End of Period: This process can be run either interactively through this update or seleted to run as a special month-end version during EOP End of Month. As an EOP module, the process is:

| EOP Only | Yes* |

| Frequency | Monthly |

| Sequential Updates | No |

| Skip Notes | No restrictions |

*The special month-end version of this report is only available through EOP End of Month, but is otherwise the same as the interactive version, using the same processing but with selection criteria specific to End of Month.

For more information about End of Period, refer to U04 End of Period Overview.

For more information about End of Period, refer to U04 End of Period Overview.

The Accounts Receivable Balancing report [R0404] provides a register of all outstanding accounts receivable items. It may be used to reference payments/charges accrued but not yet paid and to reconcile the Lease Payments Receivable General Ledger account balance on the General Ledger Entries Listing report [R0406]. The Accounts Receivable Balancing report [R0404] may also be used when reversing partial payments and prepayments via the Payment Reversal option of the Payment update [U0102].

For leases with a suspended earnings status, receivables due after the effective date of the earnings suspension are identified and reported as memo items on this report. All use tax continues to be reported as normal, however, because use tax receivables (set up in the Lease Payments Receivable General Ledger account) are unaffected by the suspended earnings status. Lease payments due on or before the earnings suspension effective date are also unaffected.

For leases extended using the RES method on a cash basis, deferred income and deferred residual are identified separately and reported as memo items on this report. They are still included in the total balance for Lease Payments Receivable and as such will print in the payments column. These fields may be used to reconcile the corresponding General Ledger account balances on the General Ledger Entries Listing report [R0406].

If the JULE Fund 1994 enhancements are purchased, advanced invoices may be produced up to 120 days before their due dates. Such invoices do not affect the G/L until they accrue, but they do appear on the Accounts Receivable Balancing report with an A (advanced) suffix on their invoice number. Subtotals for advanced invoice amounts appear for each portfolio/ company/region/office.

Two reports are produced, one for other than interest bearing loans [R0404A] and one for interest bearing loans [R0404B].

The report may be accessed through the Audit Control report menu [R04] and may be selected interactively for:

- All leases

- All customers and groups

- A portfolio

- A company

- A region

- An office

- A lease

- A customer

- A customer/group

The report may be automatically generated for each portfolio at the end of the month through the End of Period update [U0401].Use the End of Period MODULES AND REPORTS screen under the End of Period Customizations option of the Portfolio update [U0212] to specify whether the report is created.

LeasePak always uses the tax rate applicable to the lease due date, not the tax rate applicable to the date on which the accrual occurred.

Accounts Receivable Balancing Selection

- ALL

Enter X to report on all leases. Leave blank to report on a specific portfolio, company, region, office, lease, customer and/or group. If ALL is selected, leases that belong to a customer or to a group are also reported, however, these leases are sorted by their portfolio, company, region, office, and lease numbers, rather than their customer or group numbers.

- ALL

CUST

Enter X to report on all customers. Leave blank to report on a specific portfolio, company, region, office, lease, customer and/or group. If ALL CUST is selected, only leases that belong to a customer or to a group are reported (sorted by customer and group).

- PORT

Enter the number of the portfolio upon which to report. Leave blank if reporting across portfolios.

- COMP

Enter the number of the company upon which to report. Leave blank if reporting across companies.

- REGN

Enter the number of the region upon which to report. Leave blank if reporting across regions.

- OFFIC

Enter the number of the office upon which to report. Leave blank if reporting across offices.

- LEASE

Enter the number of the specific lease upon which to report.

- CUST

Enter the number of the customer upon which to report. CUST may not be entered if a portfolio, company, region, office, or lease number is entered. CUST must be entered if GROUP is entered.

- GROUP

Enter the number of the group upon which to report. GROUP may not be entered if a portfolio, company, region, office, or lease number is entered.

Accounts Receivable Balancing Report

Note: that the AR Balancing Report appears in the xml format if, on the Reports tab page of the Report Profile window, the XML Reports switch is selected.

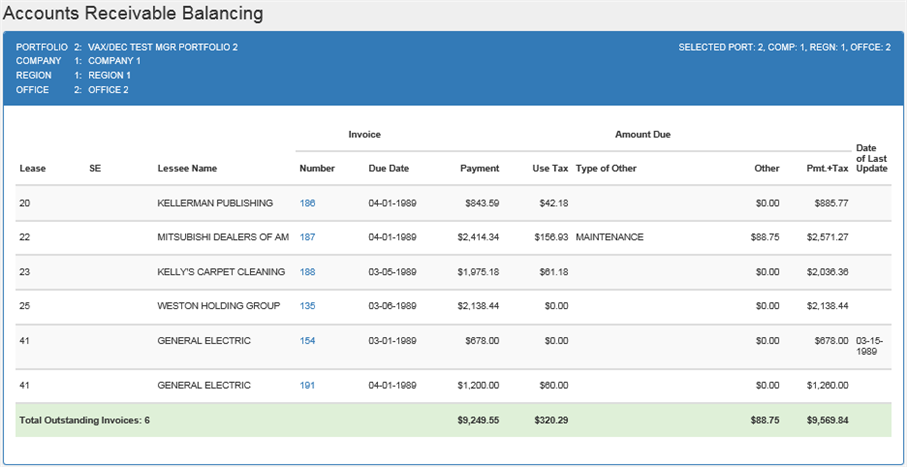

The Accounts Receivable Balancing report [R0404A] reports at the invoice level and provides the following detail for each accounts receivable item:

- LEASE

The lease number is displayed. If a Payoff [U0103] or Termination [U0103] has been performed on a lease, a 'Q' for a lease payoff, or a 'P' for an asset payoff is displayed before the lease number.

- SE

This column designates if a lease is in suspended earnings status or is extended. An asterisk (*) is displayed if the lease is in a suspended earnings status and the INVOICE DUE DATE is after the effective date of the earnings suspension. An R is displayed if the lease has been extended using the RES method on a cash basis and the INVOICE DUE DATE is after the commencement date of the extended term.

- LESSEE

NAME

The short form of the lessee name is displayed.

- INVOICE

NUMBER

The invoice number of the payment is displayed. Also displayed are credit memo numbers which indicate a prepayment has occurred. For advanced invoices which have not yet accrued, the number is followed by an A.

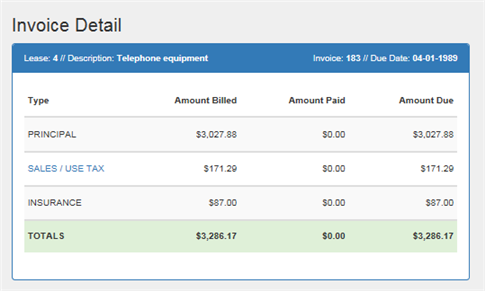

The invoice number appears as a link. Report allows the user to view the details of the invoice by the Invoice number link. The Invoice Detail window is displayed as follows:

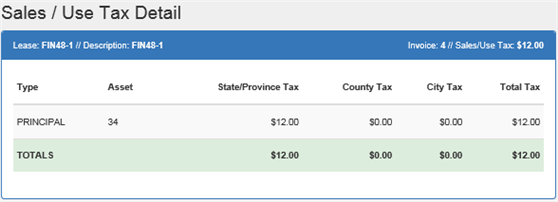

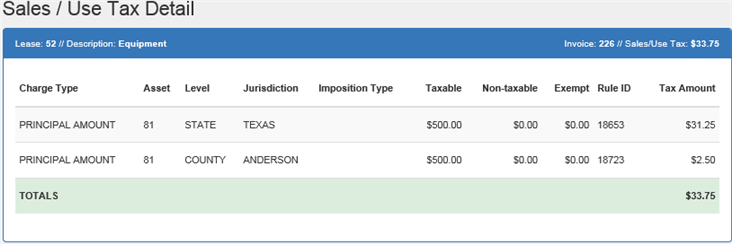

In the above screen of report, Sales / Use Tax appears as a link. Sales/Use Tax link provides the detailed view of sales tax breakdown that itemizes how much tax goes to the state, county, and city for each asset and assessment. The Sales/Use Tax Detail report is as follows:

The report displays sales tax breakdown to include separate state, county, and city amounts along with a total of all three for each asset and each type of charge. Users can re-sort the report by selecting the heading of the column by which to sort.

If, for the particular invoice, waiver records are found, the amount of the waiver will be subtracted from the amount of the matching assessment record so that the amount displayed on the Sales/Use Tax Detail report is the resulting total of all assessments and waivers for the given Type and Asset. The amount of sales/use tax shown will total to be the same as the billed amount on the Invoice Detail report. Once an assessment is waived, it is no longer considered billed and is removed from the invoice detail as well as from the Sales/Use Tax Detail report. This is different than when an assessment is paid and the billed amount does not change.

Note: that the sales tax breakdown requires data generated as part of the JULE Fund 2002-2003 module package and therefore that module is required for the data to be available. All invoices generated prior to the installation of that module will display no breakdown information.

For Vertex O users only: The above screen will only appear for vertex O invoices.

For Vertex O users only: The above screen will only appear for vertex O invoices.

R0404 AR Balancing report displays all receivables that have not yet received payment including advanced invoices that have not accrued yet.

The XMl view of R0404 details and displays invoice. Click on Invoice No. to view details.

-

Sales/Use Tax

Click to see a breakdown of the tax amount. The amount of tax is not stored in tax table, because the tax amount has not accrued. LeasePak will not display the Sales/Use Tax line when the invoice is in advance.

- INVOICE

DUE DATE

The payment due date of the invoice is displayed.

- PAYMENT

AMOUNT DUE

The lease payment amount excluding use tax is displayed. Also included in this field are any interim rents, security deposits or down payment amounts due and outstanding.

Payment amounts of invoices due after the effective date of the earnings suspension of a suspended lease are not displayed in this column. They are displayed in the OTHER AMOUNT DUE column.

Payment amounts of invoices due after the commencement date of an extended lease are displayed in this column but are reported based on their respective component; the Residual portion of the payment (if any) is reported separately from the income portion (if any). This applies to leases extended using the RES method on a cash basis. The descriptions are displayed in the TYPE OF OTHER column. These extended amounts are not included in the total at the bottom, but are instead totaled as a separate items. The TOTAL PAYMENT + TAX will include them so that LEASE PAYMENTS RECEIVABLE may be reconciled to the [R0406].

If the lease is a variable rate operating lease (accrual type AOVE or ROVE), the PAYMENT AMOUNT DUE consists of principal and interest, adjusted by the float rate. The OTHER column shows the interest adjustment. Thus PAYMENT and OTHER together equal the payment amount entered for the lease when it was originally booked. A breakdown of principal and interest can be seen on the Payments update [U0102] for the invoice and on the Collection Summary [U1101].

- USE

TAX AMOUNT DUE

The outstanding amount of use tax is displayed. Users can view a breakdown of this tax amount by selecting the invoice number link.

- TYPE

OF OTHER AMOUNT DUE

A description of additional charges or assessments due (e.g., Property Tax, Late Charges, Recurring Charges, Deferred Residual etc.) is displayed. Credit memos are also identified in this column.

If the lease is in a suspended earnings status and the INVOICE DUE DATE is after the effective date of the earnings suspension, SUSPENDED PRINCIPAL and SUSPENDED INTEREST is displayed for simple interest and precomputed type leases. SUSPENDED INTEREST is displayed for operating type leases.

If the lease is in suspended earnings with status 'N***' and the switch "Allow Prepayment to 'N***' Suspended Earnings Lease" in the Miscellaneous Customizations option of the Portfolio [U0212] update is set to 'Y', the prepayment amount (if any on the lease) is displayed as credit memo.

- OTHER

AMOUNT DUE

The dollar amount of the above referenced charges is displayed. This figure is NOT included in the PAYMENT + TAX AMOUNT DUE field.

If the lease is in a suspended earnings status and the INVOICE DUE DATE is after the effective date of the earnings suspension, the PAYMENT AMOUNT DUE is displayed separated into SUSPENDED PRINCIPAL and SUSPENDED INTEREST for simple interest and precomputed type leases. The PAYMENT AMOUNT DUE is displayed as SUSPENDED INTEREST for operating type leases. These amounts are NOT included in the PAYMENT + TAX AMOUNT DUE field.

If the lease is in suspended earnings with status 'N***' and the switch "Allow Prepayment to 'N***' Suspended Earnings Lease" in the Miscellaneous Customizations option of the Portfolio [U0212] update is set to 'Y', the prepayment amount (if any on the lease) is displayed as credit memo.

- PAYMENT

+ TAX AMOUNT DUE

The total of PAYMENT AMOUNT DUE and USE TAX AMOUNT DUE is displayed.

- DATE

LST UPDATE

The processing date of the most recent payment is displayed. If no payment has been made on this invoice, the date the invoice was last changed (e.g., through the Cycle Accrual update [U0301]) is displayed.

- INTEREST

ADJUSTMENTS

Any interest adjusted is displayed (e.g. interest unpaid, interest carryover, etc.). Positive amounts indicate interest due on outstanding invoices. Negative amounts indicate interest overpaid.

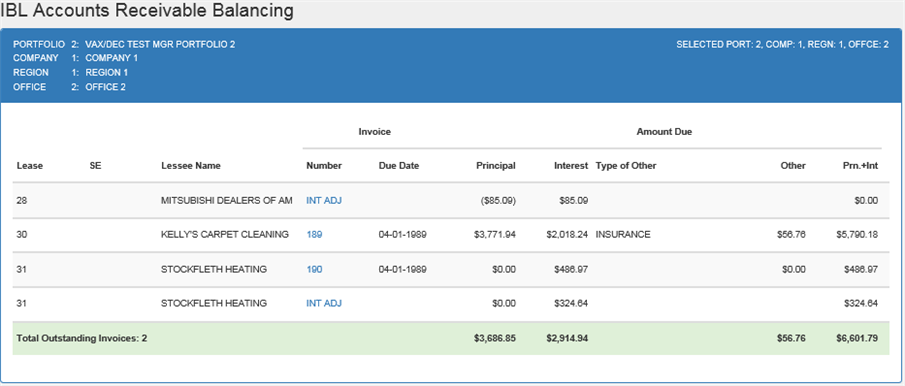

IBL Accounts Receivable Balancing Report

The IBL Accounts Receivable Balancing report [R0404B] reports at the invoice level and provides the following detail for each accounts receivable item:

- LEASE

The lease number is displayed.

- SE

An asterisk (*) is displayed if the lease is in a suspended earnings status and the INVOICE DUE DATE is after the effective date of the earnings suspension.

- LESSEE

NAME

The short form of the lessee name is displayed.

- INVOICE

NUMBER

The invoice number of the payment is displayed.

- INVOICE

DUE DATE

The payment due date of the invoice is displayed.

- PRINCIPAL

AMOUNT DUE

The loan principal amount excluding interest is displayed. Also included in this field are any interim rents, security deposits or down payments amounts due and outstanding.

Principal amounts of invoices due after the effective date of the earnings suspension of a suspended lease are not displayed in this column. They are displayed in the OTHER AMOUNT DUE column.

- INTEREST

AMOUNT DUE

The calculated interest due plus any interest adjustments carried over from previous invoices are displayed.

Interest amounts of invoices due after the effective date of the earnings suspension of a suspended lease are not displayed in this column. They are displayed in the OTHER AMOUNT DUE column.

- TYPE

OF OTHER AMOUNT DUE

A description of additional charges or assessments due (e.g., Use Tax, Property Tax, Late Charges, Recurring Charges, etc.) is displayed. If the Name Assessments module is purchased, the customized assessment names will be displayed.

If the lease is in a suspended earnings status and the INVOICE DUE DATE is after the effective date of the earnings suspension, SUSPENDED PRINCIPAL and SUSPENDED INTEREST is displayed.

If the lease is in suspended earnings with status 'N***' and the switch "Allow Prepayment to 'N***' Suspended Earnings Lease" in the Miscellaneous Customizations option of the Portfolio [U0212] update is set to 'Y', the prepayment amount (if any on the lease) is displayed as credit memo. The rule does not apply on matured IBLs (i.e. matured 'N***' suspended earnings leases and 'NMAT' matured leases).

- OTHER

AMOUNT DUE

The dollar amount of the above referenced charges is displayed. This figure is NOT included in the PRIN + INT AMOUNT DUE field.

If the lease is in a suspended earnings status and the INVOICE DUE DATE is after the effective date of the earnings suspension, the SUSPENDED PRINCIPAL and SUSPENDED INTEREST amounts are displayed. These amounts are NOT included in the PRIN + INT AMOUNT DUE field.

If the lease is in suspended earnings with status 'N***' and the switch "Allow Prepayment to 'N***' Suspended Earnings Lease" in the Miscellaneous Customizations option of the Portfolio [U0212] update is set to 'Y', the prepayment amount (if any on the lease) is displayed as credit memo. The rule does not apply on matured IBLs (i.e. matured 'N***' suspended earnings leases and 'NMAT' matured leases).

- PRIN

+ INT AMOUNT DUE

The total of PRINCIPAL AMOUNT DUE and INTEREST AMOUNT DUE is displayed.

- DATE LST UPDATE

The processing date of the most recent payment is displayed. If no payment has been made on this invoice, the date the invoice was last changed (e.g., through the Cycle Accrual update [U0301]) is displayed.

- INTEREST

ADJUSTMENTS

Positive amounts indicate interest due on outstanding invoices. Negative amounts indicate interest overpaid.

Additional interest charges which result from a late payment appear as part of INTEREST AMOUNT DUE on the next invoice accrued after the late payment's due date. They do not appear as INTEREST ADJUSTMENTS.Note: Before LeasePak release 2.1a, such additional interest charges were added as INTEREST ADJUSTMENTS to the invoice on which the principal was originally billed.

Interest credits are automatically applied to subsequent interest billed. They are always applied to interest, never to principal.

- TOTALS

Page totals for the number of outstanding invoices and all dollar amounts are shown by office. Group totals are shown if customer/group is selected.Totals are shown for advanced payments by office. Region, company, portfolio and grand totals are shown for the number of invoices and all dollar amounts. Customer totals are shown if customer/group is selected.

If the report includes invoices for leases placed on earnings suspension, and the invoices are due after the effective date of the suspension, the suspended payment amounts due are totaled separately as SUSPENDED PRINCIPAL and SUSPENDED INTEREST under the OTHER AMOUNT DUE column. All other charges listed under this column are totaled as ALL OTHER CHARGES.

Balancing Procedures

The PAYMENT + TAX AMOUNT DUE totals for each accounting unit (portfolio, company, region, and office) should balance to the Lease Payments Receivable General Ledger account on the General Ledger Entries Listing report [R0406]. When balancing, both the Accounts Receivable Balancing report [R0404] and the General Ledger Entries Listing report [R0406] should be generated at the same time.

LeasePak Documentation Suite

©

by NetSol Technologies Inc. All rights reserved.

The information contained in this document is the property of NetSol Technologies Inc. Use of the information contained herein is restricted. Conditions of use are subject to change without notice. NetSol Technologies Inc. assumes no liability for any inaccuracy that may appear in this document; the contents of this document do not constitute a promise or warranty. The software described in this document is furnished under license and may be used or copied only in accordance with the terms of said license. Unauthorized use, alteration, or reproduction of this document without the written consent of NetSol Technologies Inc. is prohibited.