U04 End of Period

U04 End of Period

U0439 Automatic Suspended Earnings

| EOP Only | Yes |

| Frequency | Daily |

| Sequential Updates | Yes |

| Skip Notes | No restrictions |

For more information about End of Period,

For more information about End of Period,

refer to U04 End of Period Overview.

Sequential Updates: This EOP module runs as part of U0411 Sequential Updates.

Sequential Updates: This EOP module runs as part of U0411 Sequential Updates.

This EOP process requires the Automatic Suspended Earnings optional license module.

This EOP process requires the Automatic Suspended Earnings optional license module.

This module will automatically suspend income for leases that have been delinquent based on the number of days entered in the AUTO SUSPEND DAYS field in U0212 Portfolio→Miscellaneous Customizations. Additionally, LeasePak will unsuspend leases based on the number of days entered in the AUTO UNSUSPEND DAYS field in U0212 Portfolio→Miscellaneous Customizations. Only leases with active status or normal matured status can be automatically suspended.

The auto unsuspend leases feature of the automatic suspended earnings module does not work in EOP when the leases are delinquent less than the number of days entered in the AUTO SUSPEND DAYS field in U0212 Portfolio→Miscellaneous Customizations.

This module is run daily as part of Sequential Updates. Its status does not appear separately on the U0402 Status Review, but is reflected in the status of U0411 Sequential Updates.

Leases that have been extended using the RES method under cash basis accounting rules may not be suspended. Leases which are suspended will be put into Suspense Accrual Hold (NHLD) status. The procedure is an automated process of a subset of the interactive U0115 Suspended Earnings. Refer to U0115 Suspended Earnings for more information.

The Auto Suspended Earnings update allows earnings for a non-performing lease to be suspended while billing with accurate General Ledger reporting continues. Invoicing and accruals continue with no interruption. Internally, however, parallel General Ledger accounts are used to record lease payment receivables and income for suspended leases.

When income earnings are suspended, all outstanding lease payment receivables (due after the effective date of the earnings suspension) and unbilled interest (as of the effective date) are transferred to suspended General Ledger accounts. Note that receivables due on or before the effective date of the earnings suspension are unaffected.

The accrual process sets up receivables in the suspended receivables G/L accounts (separated into principal and income portions) and income in the Suspended Income Accrued G/L account. Invoicing continues as normal. If a payment is received, the payment is allocated against principal and income in the usual manner. The amount of income paid is accumulated in a suspended income collected Master Financial (RLS) field.

If earnings are reinstated for the account, the Suspended Income Accrued is transferred to the normal G/L account. If a lease is paid off or terminated with a suspended status, the payoff or termination transaction is called a charge off. If the account is charged off, suspended income collected is re-applied against the remaining principal balance or contract receivable before any loss/amount to charge against bad debt reserve is calculated.

As a process of EOP to run daily this update support the additional IDC fields (IDC8, IDC9, and IDCA-IDCH) same as for IDC3 – IDC5 when the lease becomes suspended.

Note: Leases in a portfolio that uses the Lease Discounting feature cannot be suspended. Refer to U0123 Lease Discounting for more information.

In Auto-Suspended Earnings, delinquency calculation depends on 2 factors:

- 10% rule - The unpaid rental payment of the oldest delinquent invoice is greater than 10% of the rental payment billed. The outstanding assessment amount is not considered as a factor in this calculation.

The following example illustrates a lease which falls into the 10% rule, since the unpaid portion of the rental payment is $101.00, which is more than 10% of the rental payment ($1,000).

Invoice 123 Rental payment = $1,000.00

Late charge = 25.00

Rental payment paid = 899.00

Unpaid portion of rental payment = $ 101.00 - Delinquent lease.

The days delinquent period is based on the elapsed time between today's system date, and the date of the oldest outstanding invoice whose payment is within the 10% rule.

For example: If the AUTO SUSPEND DAYS field is set to 60, Lease 123 is to be automatically suspended at 60 days delinquent. Lease 123 has 2 outstanding invoices with payment due dates on Jan. 15 and Feb 15. On March 15, lease 123 will be automatically suspended:

Date Days January 16-31 16 February 28 March 31 Total 60

When the RECOGNIZE SUSP INCOME AT TIME OF PAYMENT switch is set to 'Y', G/L accounts will "reinstate earnings" Suspended Income accrued will be debited and the Lessor income will be credited.

Leases that are suspended will appear on the R0602 Suspended/Non-Accrual Leases.

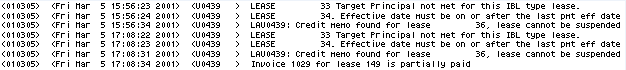

Leases that should have been suspended but could not be will be recorded in ERR:EXEOP_Pxx_U0439.XPN file, where "xx" is the portfolio number. The log file is not sent to the printer automatically after the End of Period process.

The following are conditions under which a lease cannot be suspended automatically.

- Lease discounting used. Leases cannot be suspended.

- Credit memo found for the lease.

- Invoice has been written.

- Transaction is in progress.

- Lease has already been accrued.

- Prime rates record does not exist.

- RTP record already exists

- Location record does not exist.

- Error in next payment due date.

- States record does not exist.

- LSACCFLT error; could not decipher code.

- IBL negative amortization.

- IBL Target Principal not met.

- No estimated term specified for month-to-month lease.

- A/R record does not exist.

- A/R record is already paid.

- A/R record is partially paid.

- Number of tax payable records (RTP) of use tax type is not equal to number of assets in the lease.

- Incomplete lease/portfolio information.

- Effective date must be on or after the commencement date.

- Effective date must be on or before the current accrued to date.

- Effective date must be on or after the last payment effective date.

- Effective date must be on a payment or accrual due date.

General Ledger Transactions

The following general ledger transaction will be produced for IDC ASC 842 when a lease becomes suspended:

| Debit | Credit | ||

| 667 | SUSPENDED IDC ACCRUED - ASC 842 | 666 | UNAMORTIZED IDC COST - ASC 842 |

The following general ledger transaction will be produced for IDC ASC 842 when "Prorate Inc IDC/IDR (Y/N)" is set to Y from U0212 Portfolio→Miscellaneous Customizations.

| Debit | Credit | ||

| 671 | DEFERRED SUSP IDC ACCRUED - ASC 842 | 670 | DEFERRED IDC AMORTIZATION - ASC 842 |

The general ledger transactions reflects the current book IDC accounting as it does today when book IDC accounting method is set to AMOR or AMR2.

Auto Suspended Earnings Exceptions

When the Auto Suspended Earnings Exception Report is printed, it will display the error messages similar to the sample above.