Book Gain/Loss [R0108]

End of Period: This process can be run interactively through this update or seleted to run as either a special month-end or year-end version during EOP End of Month and/or End of Year. As an EOP module, the process is:

End of Period: This process can be run interactively through this update or seleted to run as either a special month-end or year-end version during EOP End of Month and/or End of Year. As an EOP module, the process is:

| EOP Only | Yes* |

| Frequency | Monthly/Yearly |

| Sequential Updates | No |

| Skip Notes | No restrictions |

*The special month-end and year-end versions of this report are only available through EOP End of Month and End of Year respectively, but are otherwise the same as the interactive versions, using the same processing but with selection criteria specific to either End of Month or End of Year.

For more information about End of Period, refer to U04 End of Period Overview.

For more information about End of Period, refer to U04 End of Period Overview.

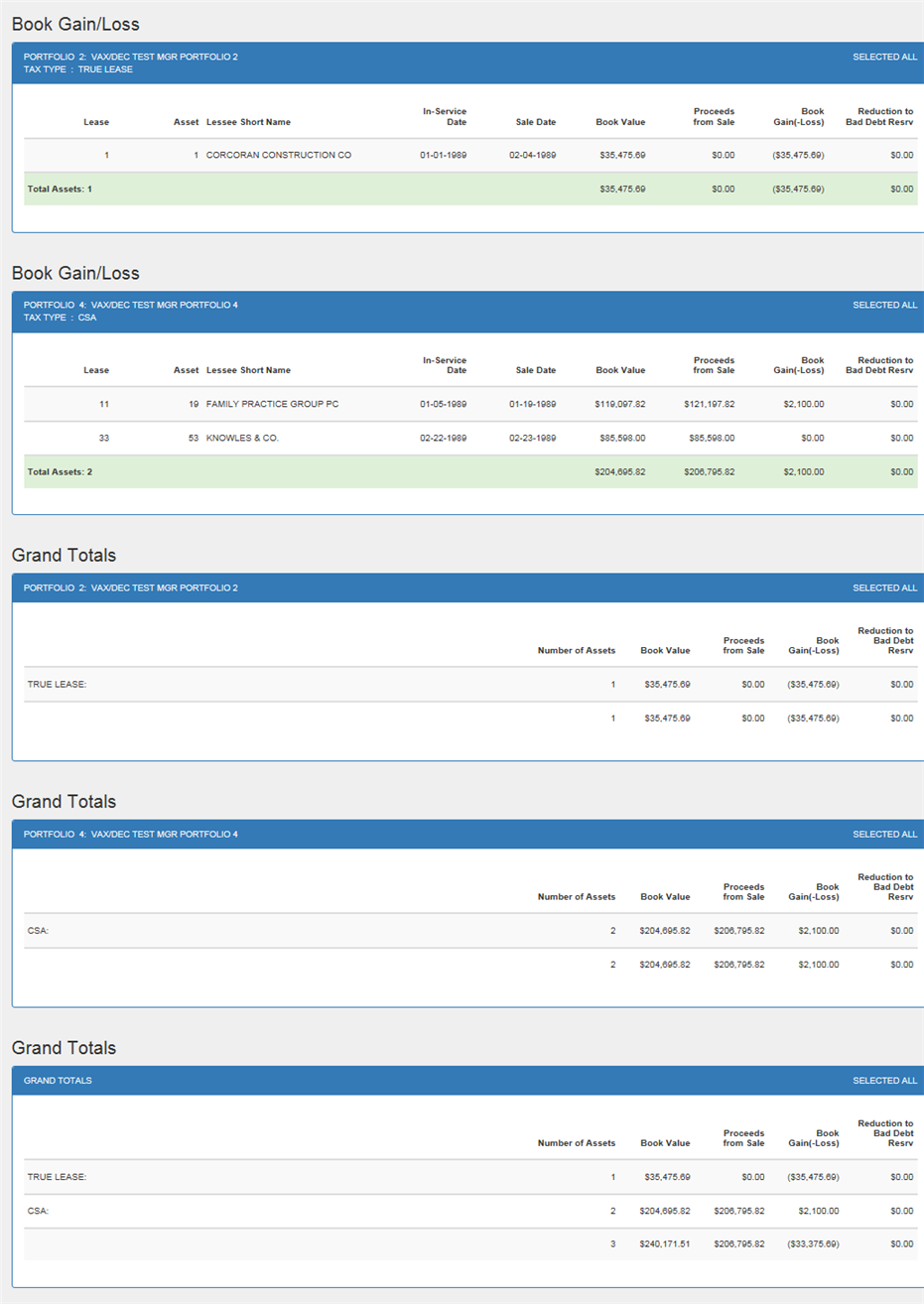

The Book Gain/Loss report [R0108] provides book gain or loss information and/or use of the allowance for bad debt reserve for assets sold during the fiscal year. Included in this report are assets sold either through a lease or asset payoff or through the sale of off-lease inventory (using the Payoff update [U0103]).

The report may be accessed through the Strategic Management report menu [R01] and may be selected interactively for:

- all sold assets

- a portfolio

The report may be automatically generated for each portfolio at the end of the month through the End of Period update [U0401]. Use the END OF PERIOD MODULES AND REPORTS screen under the End of Period Customizations option of the Portfolio update [U0212] to specify whether the report is created.

The report is organized by all of the following:

- Portfolio

- Tax

type (True Lease and CSA)

Book Gain/Loss Selection

- ALL

Enter 'X' to report on all sold assets for the fiscal year. Leave blank to report on a specific portfolio.

- PORT

Enter the number of the portfolio upon which to report. Leave blank if reporting across portfolios.

Book Gain/Loss Report

The Book Gain/Loss report [R0108] reports at the lease or asset level and provides the following information:

- LEASE

The lease number is displayed (except for assets sold through the Sale of Asset in Inventory option of the Payoff update [U0103]).

- ASSET

The asset number is displayed.

- LESSEE

SHORT NAME

The short form of the lessee name is displayed (except for assets sold through the Sale of Asset in Inventory option of the Payoff update [U0103]).

- COMMENCE DATE

The commencement date of the lease is displayed in MM/DD/YY or DD/MM/ YY format, depending on the Date Format Preference field in Security [U0706], (except for assets sold through the Sale of Asset in Inventory option of the Payoff update [U0103]).

- SALE DATE

The effective date of the lease or asset payoff, or the date of sale of the asset is displayed in MM/DD/YY or DD/MM/YY format, depending on the Date Format Preference field in Security [U0706].

- BOOK

VALUE

The financial book value is displayed for lease or asset payoffs and is calculated as follows:For precomputed interest type leases:

CONTRACT RECEIVABLE

+ RESIDUAL

- UNEARNED INCOME

+ UNAMORTIZED TAX IDC

For simple interest type leases:

PRINCIPAL OUTSTANDING

For operating leases:

ORIGINAL

ASSET COST

-

ACCUMULATED BOOK DEPRECIATION

The inventoried value of the asset is displayed for assets sold from inventory.

- PROCEEDS FROM SALE

The amount received from the payoff or the sale of the off-lease asset in inventory is displayed. This amount is the total amount received, exclusive of any amounts refunded, amounts placed in suspense, amounts applied to any current payment or assessment receivable, etc. In other words, PROCEEDS FROM SALE does not include any amount applied to anything other than the financial book value. (These amounts excluded from PROCEEDS FROM SALE are, in turn, reported on the Taxable Income report [R0301].)

- BOOK

GAIN(-LOSS)

The amount of the book gain or loss on sale is displayed. A loss is recorded if proceeds are less than the current book value and is signified by a negative number. A gain is recorded if proceeds are greater than the current book value and is signified by a positive number. The gain or loss is calculated as follows: - REDUCTION

TO BAD DEBT RESRV

The amount of reduction to the bad debt reserve is displayed. Bad debt may be used only when the total proceeds do not cover the payoff, termination, or sale amount (i.e., a shortage exists).

- TOTALS/GRAND

TOTALS

Page totals reflect the number of assets and all dollar amounts for each portfolio and lease type.

Portfolio and grand totals are shown for the number of assets and all dollar amounts.

PROCEEDS FROM

SALE

- BOOK VALUE

Additonal Notes

The tax type is defined at the asset level when the asset is entered into the system through the Add Asset option of the New Lease update [U0101]. Tax type describes the categorization of the asset for tax reporting. There are two basic tax types:

- True Lease

A 'true lease' is one which is considered a true lease (or operating lease) for tax purposes.

- CSA

A 'conditional sales agreement' (CSA) is one which is considered a direct finance lease for tax purposes.

LeasePak Documentation Suite

©

by NetSol Technologies Inc. All rights reserved.

The information contained in this document is the property of NetSol Technologies Inc. Use of the information contained herein is restricted. Conditions of use are subject to change without notice. NetSol Technologies Inc. assumes no liability for any inaccuracy that may appear in this document; the contents of this document do not constitute a promise or warranty. The software described in this document is furnished under license and may be used or copied only in accordance with the terms of said license. Unauthorized use, alteration, or reproduction of this document without the written consent of NetSol Technologies Inc. is prohibited.